August 8, 2022

If you are like most investors, your borrowing capacity will have a major impact on the growth of your portfolio. Your budget for each purchase will usually be highly dependent on how much money you can access. And your ability to take out further loans will dictate whether you can buy further investment properties.

But no matter how successful of an investor you are, there is a limit to how much you can borrow. So, what happens when you have reached your capacity and cannot borrow more? How do you keep your investment growing and continue making progress toward your goals?

Do you like it?

July 28, 2022

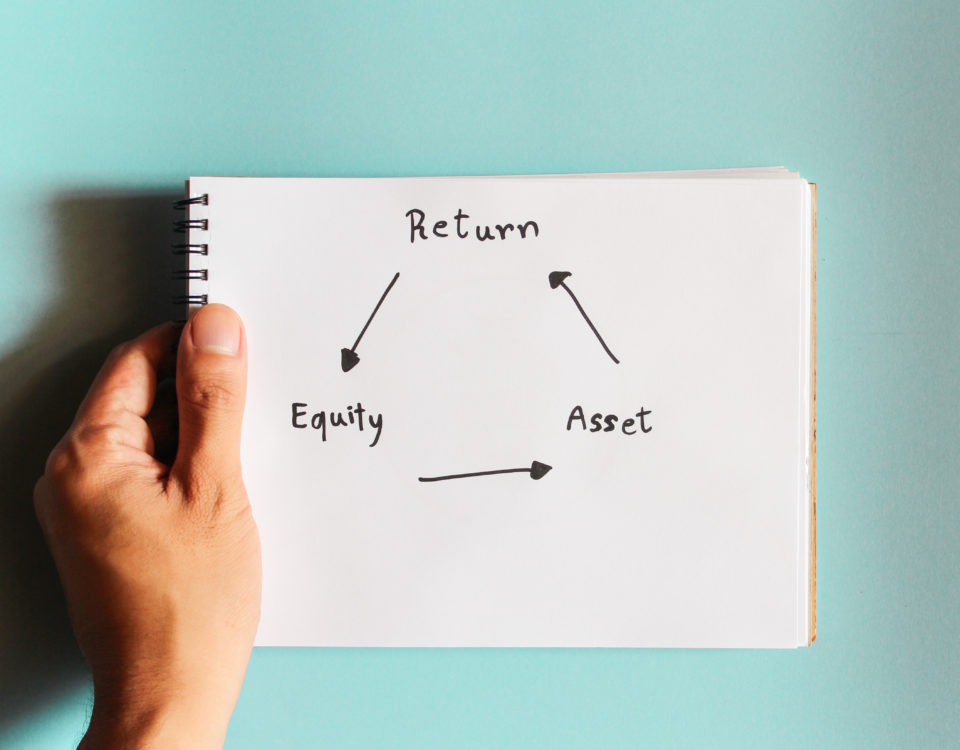

As a property investor, equity is the key to your long term success. It reflects the increasing value of your portfolio and will make up a significant proportion of your returns. It can also help fund further growth of your portfolio, either through renovating your existing properties or buying new ones.

But exactly how do you use your existing equity to boost your portfolio growth? And how do you make sure you are getting the best possible return from this reinvestment?

Do you like it?

July 20, 2022

With another financial year now behind us, it is time to start thinking about doing your taxes. While this is not something anyone particularly enjoys, it can be especially difficult – and confusing – for property investors. With additional assets, income sources, and deductions to declare, investors’ returns tend to be a lot more detailed.

This is why we always recommend you engage a qualified and experienced accountant to look after your taxes. They will do all the hard work for you and guide you through collating all the information you need. They should also be able to suggest ways to minimise your obligations and bring down your annual tax bill.

Do you like it?

July 13, 2022

As every successful property investor knows, a balanced portfolio is a strong portfolio – and the key to balance is diversity. By actively targeting a variety of investment opportunities, you make your returns less dependent on the movements of individual markets. You also increase your ability to achieve consistent growth by capitalising on the strength of different market segments.

But what are the best ways to increase the diversity and improve the balance of your portfolio? Here we look at the three main approaches adopted by many of Australia’s most experienced investors.

Do you like it?

July 12, 2022

The downward trend in property prices is continuing, with the national median dwelling value

dropping 0.6% in June. Importantly, this decrease has also pushed quarterly growth figures into

negative territory, with national dwelling values down 0.2% since March.

As in previous months, this is mostly being driven by declines in Sydney and Melbourne. Both

markets slowed further over June, with median prices down 1.6% and 1.1% (respectively) for the

month.

Do you like it?

July 6, 2022

Many areas have experienced a property boom since the start of the global pandemic. But while most markets have started to cool, Queensland continues to power on, delivering fairly consistent growth. The state’s population also continues to swell, with some predicting it will hit 6 million by 2027.

Here we take a closer look at the Sunshine State’s current property boom and exactly what is driving it. We also look ahead and try to predict how long the good times are likely to last. And, most importantly, we will consider what this means for property investors and the moves you should be making.

Do you like it?

June 29, 2022

Property has long been seen as a solid investment here in Australia. In fact, the Australian property market has largely experienced steady growth and delivered stable returns since the early 1900s. This has only become more pronounced over the last few decades as market cycles create increasingly steeper peaks.

But it is not just the gains you can achieve on an investment property that is different now. Just like the property market itself, the whole investment process is dynamic and constantly evolving. Here we look at how property investing has changed over time and the influence this has on the modern investor.

Do you like it?

June 20, 2022

Of all the costs associated with owning an investment property, land tax is easily one of the most overlooked. In fact, it is likely that many investors with smaller portfolios would not know anything about this potential expense. There would also be some who know what land tax is but assume it will never apply to them.

To help address this, we want to take a closer look at how land tax works. We will explore why it is such an important consideration for you as an investor, particularly as your portfolio grows. We will also share some of the strategies successful investors use to manage their land tax obligations.

Do you like it?

June 18, 2022

The RBA’s recent decision to increase the cash rate has many market watchers worried about widespread mortgage distress. And talk of further interest rate rises has many mortgage holders worried that they will struggle to make ends meet. But how much more should you really be expecting to pay?

Here we take a quick tour around the capitals and look at how much the average mortgage payment will increase. We also consider what this increase means, in real terms, for the average mortgage holder.

Do you like it?

June 13, 2022

As experienced buyers agents, we understand better than most the power property investing has to change lives. We have worked with investors who have built serious wealth from the most humble beginnings. We have also witnessed the flexibility, stability, and financial security owning investment properties can provide.

Here we take a closer look at what having a high performing property portfolio allows you to do. We also share some of the more interesting and inspiring ways we have seen successful investors use their returns.

Do you like it?