- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

July 2021 – Property Market Update

July 2021 Property Market Update

For a month where most of the country spent some time in lockdown, the property market was surprisingly resilient. While weekly sales volumes did wane noticeably across the month, clearance rates held firm. In fact, according to CoreLogic, the national clearance rate hovered around 73% – 75%, before jumping up to almost 80% in the last week.

This suggests that, while supply may be drying up, there is still plenty of demand. It also shows that, while lockdowns may be causing sellers to reconsider listing their properties, buyers are still pushing forward.

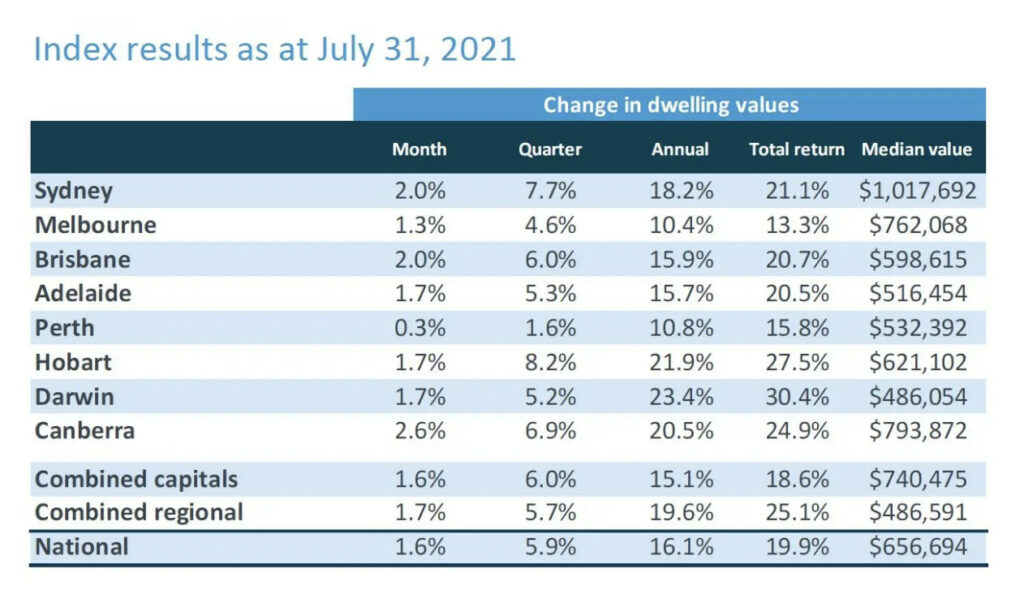

This is important for investors to note, as it’s having an effect on sales prices. In fact, the national median property price has increased by approximately 1.6% over the month. While this does represent a slowing of price growth compared to the 1.9% increase seen in June, it is only slight.

Source: Corelogic

It is also important for investors to be across how different markets are performing. For example, CoreLogic data shows us that Canberra has been the strongest performing capital, with clearance rates consistently around 90%. Similarly, Newcastle has been one of the most stable regional areas, with clearance rates hanging around the 80% mark.

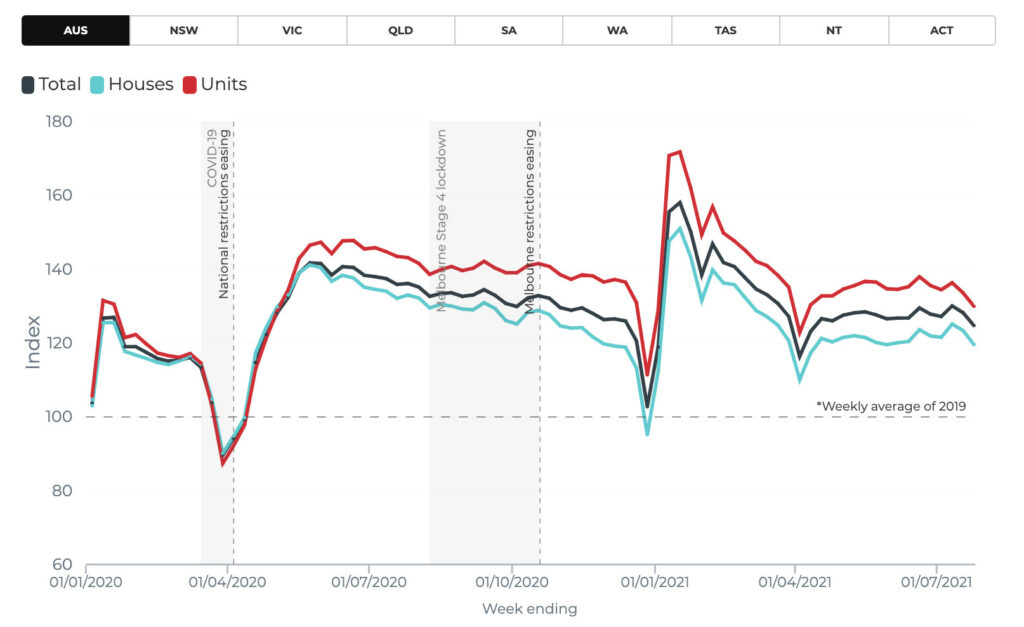

On the rental side, it is good news for investors, with demand remaining strong. While the market has noticeably cooled since the start of the year, it is still tracking well above pre-pandemic numbers. In fact, according to REA insights, despite a dip over the last week, rental demand remains 25% higher than the 2019 average.

Source: July 28 REA Insights Weekly Rental Demand Report, 2021

Expectations for the Month Ahead

Given the ongoing lockdowns in Sydney and the potential for restrictions in most other major markets, forecasting is tricky. However, there are a few developments we are fairly confident we will see over the coming month:

- Supply will dry up further: Restrictions on inspections and auctions are clearly making sellers hesitant to list their properties. This is particularly true in Sydney, which will remain in lockdown until at least the end of the month.

- Median prices will continue to increase: Given supply remains limited and buyer interest remains strong, property values should continue to grow. However, gains are likely to be more modest, potentially hovering around the 1% mark.

- Smaller capital cities and regional areas will continue to be the strongest performers: The potential for further lockdowns will likely continue to inhibit the major capital city markets. However, the movement toward the regions is not slowing down, so demand and price growth in these areas should remain strong.

Suburb Spotlight: Redcliffe (QLD)

Each month, we are going to share some insight into one of the suburbs that has caught our attention. This month, we are going to focus on the Redcliff in Queensland.

Situated in the Moreton Bay area, Redcliffe is a beachside suburb that sits about 28km North-East of Brisbane. It was the site of the first European colony established in Queensland and has since become a popular resort destination. This gives the area a laidback, coastal feel that is highly sought after by buyers and renters alike.

For us, the major appeal of Redcliffe is the recent growth in property prices. Over the last 12 months, house prices in the area have increased by almost 14%, to approximately $500k. Impressively, roughly half this growth has happened over the last few months.

Units have experienced similar gains over the last year, with median prices increasing by almost 20% to just short of $450k. This is a significant improvement on the average annual growth, which traditionally sits at about 1%.

Despite the recent price growth, properties in the Redcliffe area can still deliver solid rental returns. In fact, average gross rental yields are currently sitting at 4.16% for houses and 4.41% for units. This makes it a prime location to find great investment opportunities.

At Search Party Property, we specialise in developing tailored investment strategies and will work with you to come up with a suitable plan of attack. We also regularly assess your strategy ensuring that it is fit for purpose and delivering the desired results.