- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

31st August 2023 – Property Market Update

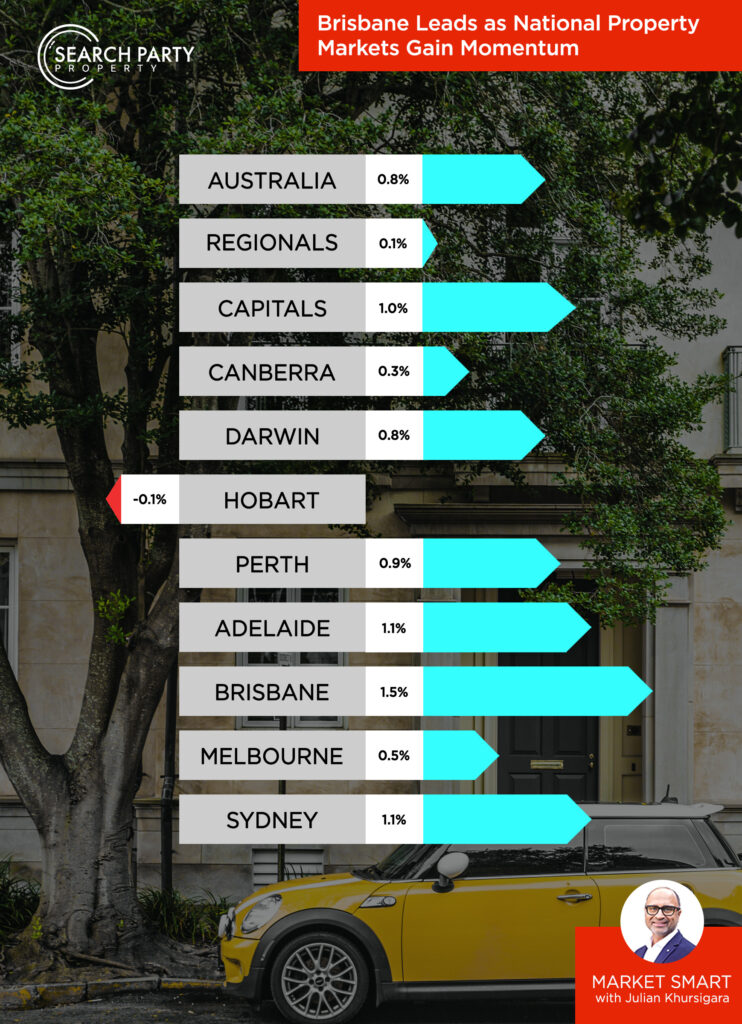

Brisbane Leads as National Property Markets Gain Momentum

In this month’s Market Smart, we cast a spotlight on the burgeoning growth in Brisbane, compare it to national markets, and discuss some potential paths that the market may take in the months ahead.

Where we are now?

The combined value of Australian housing surpassed the significant value milestone of $10 trillion at the end of August – marking a return to aggregate values we haven’t seen since June 2022. The median home value in Australia stands at $732,886, with the stock of housing rising to around 11 million properties.

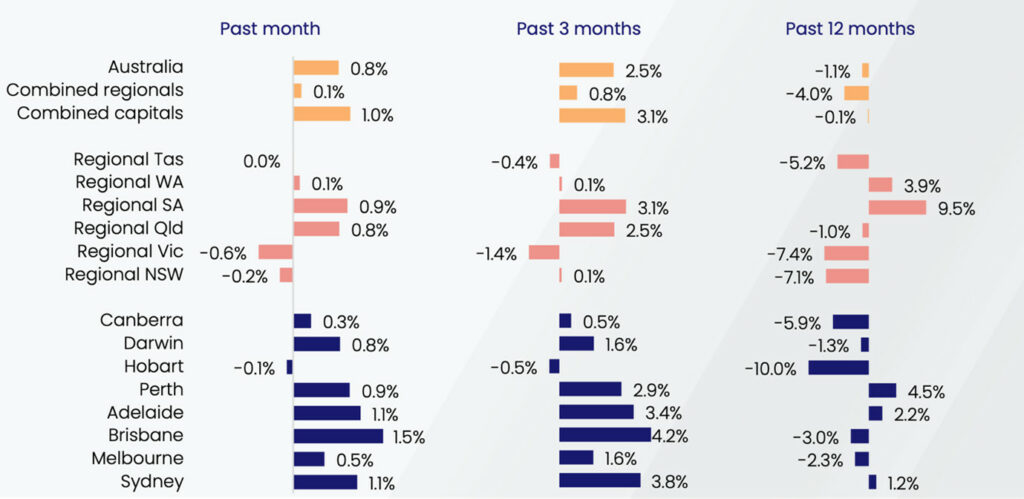

Brisbane led the gains throughout August, with a 1.5% increase in home values. Sydney and Melbourne also showed notable trends in property prices over the past month.

How did we get here?

- Supply Levels:

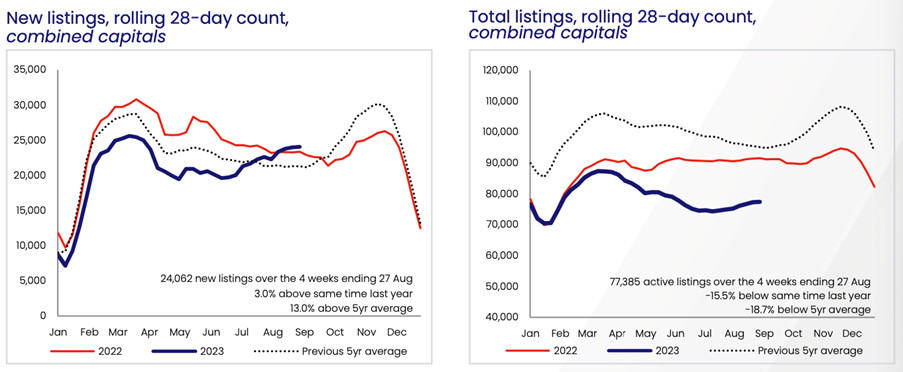

As has been the story for much of this year, advertised supply levels have again been a key factor supporting the upward pressure on home values. Despite an increase in new listings, total advertised supply levels remain significantly lower than a year ago.

In Perth, Adelaide and Brisbane, total listings measure as much as 40% below five-year averages and are trending lower. Meanwhile, the most significant growth in listings was observed in Canberra, Sydney, and Melbourne, with growth of 10.2%, 9.8% and 8.3% respectively. Though again, even in these top performing cities, supply remains well below historic averages.

- Migration and Housing Demand:

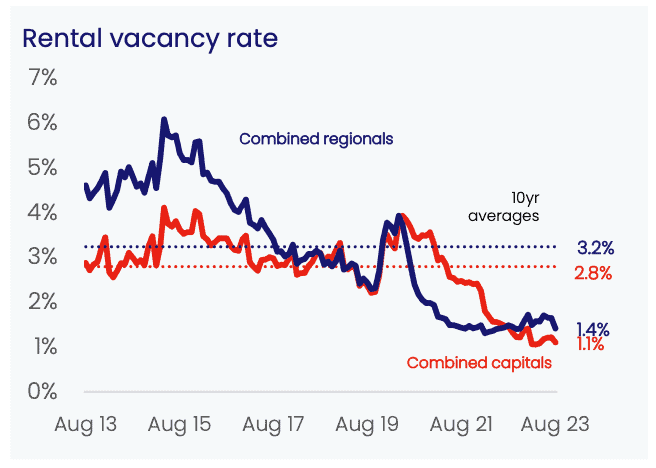

As we’ve commented in prior articles, housing demand has witnessed a significant boost, driven by a surge in returning overseas arrivals coupled with a decrease in overseas departures. In the previous year, the country saw a decline of approximately 25% in departures compared to the pre-pandemic baseline, even as the number of international arrivals experienced a slight increase compared to 2019 figures. This trend, coupled with a consistently low average household size in the major cities, is escalating the demand for housing. It may also be fostering heightened competition for available properties in the market, particularly given that the rental vacancy rates are hovering at historically low levels.

- The Rental Market

In August, the national rental index saw a marginal increase of 0.5%, marking its smallest monthly rise since November 2020, yet extending the growth streak to 36 months. Despite the general slowdown in the pace of rental growth across various regions, the annual rate stood at 9.0%, nearly triple the decade average of 3.2%. Notably, Melbourne and Perth experienced record annual growth rates in their respective housing and unit sectors, although a deceleration has been observed since May.

Meanwhile, rental vacancy rates have tightened, with the combined capitals recording a historic low of 1.1% and regional vacancies dropping to 1.4%. This contraction in vacancy rates, coupled with a decrease in rental listings and dwelling approvals, hints at a bleak outlook for rental supply. Furthermore, the gross rental yields have been on a downward trajectory since peaking in April, indicating a faster increase in housing values compared to rental rates.

Where are we going?

Heading towards the Spring selling season, the market direction remains uncertain. Despite initially pessimistic forecasts, the combined capital cities have witnessed a 4.9% surge in value year-to-date, indicating a market defying expectations and showcasing robust growth.

Borrower Activity

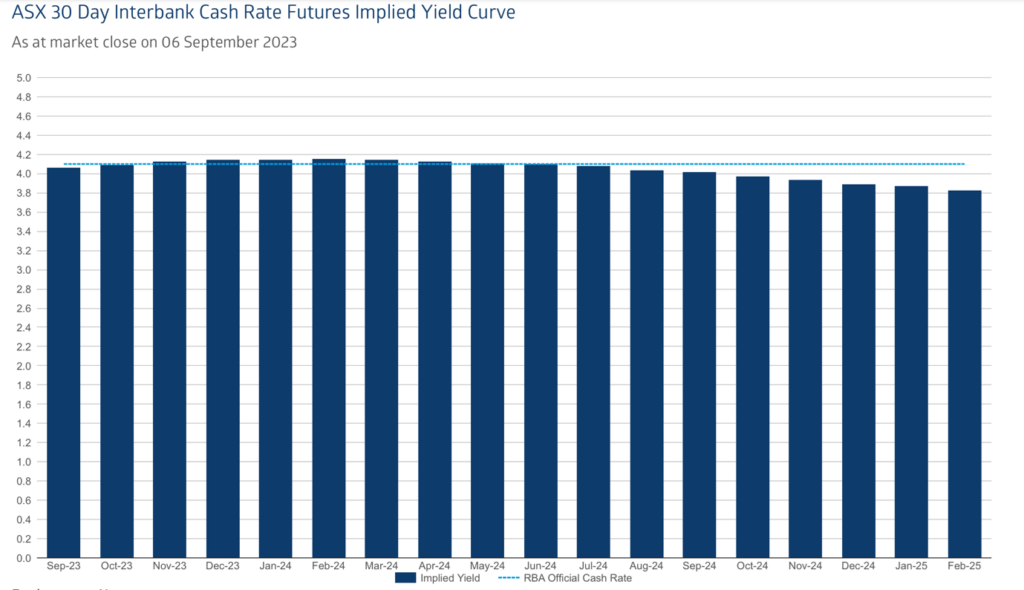

As demonstrated by cash rate futures (below), there is an increasing belief that the RBA board may have concluded its cash rate increments, yet borrowing is still limited due to a significant serviceability buffer. According to data from APRA up until June, the average home loan assessment rate hovered slightly under 9%. Moreover, recent ABS statistics on housing lending indicate a decline in mortgage lending in three of the last four months.

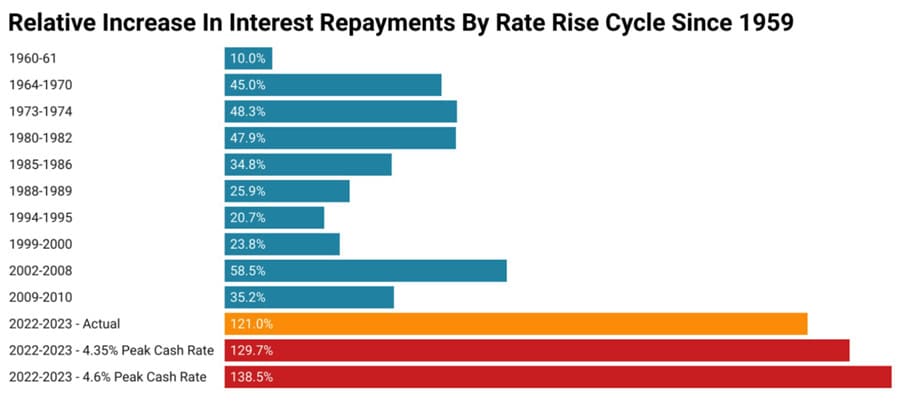

In the current cycle, the surge in mortgage interest repayments has produced an unprecedented 121% rise in costs, significantly surpassing the previous peak increase of 58.5% observed from 2002 to 2008.

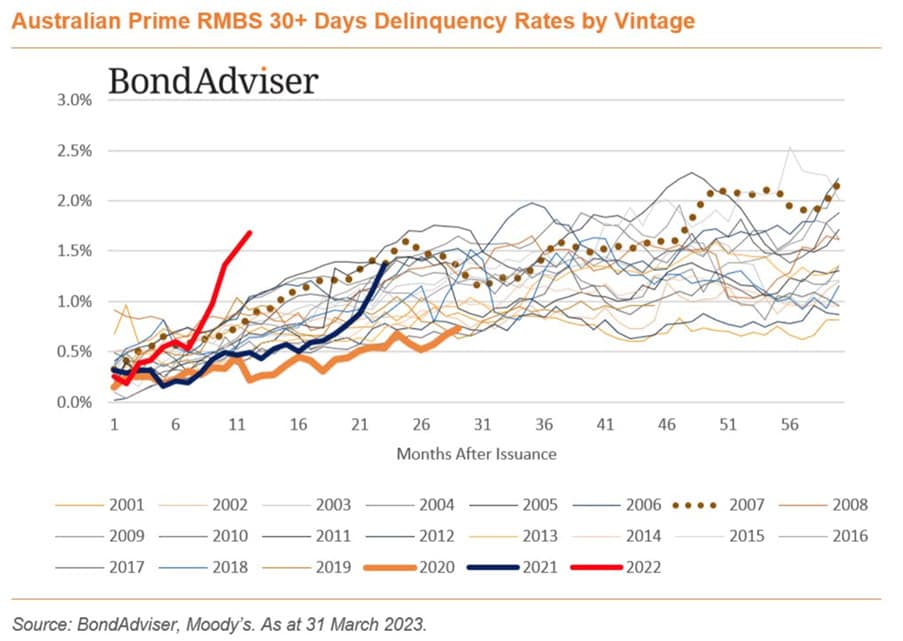

This steep ascent in repayment rates has triggered a spike in mortgage delinquencies, with unprecedented increases in 30-day or more arrears on prime residential mortgage-backed securities from the 2022 batch, as highlighted by Moody’s recent data:

It all appears to indicate that now could well be a window of opportunity for investors to capitalise – with an expected cash rate pause until well into 2024 and supply levels expected to rise significantly into the spring season.

At Search Party Property, we specialise in developing tailored investment strategies and will work with you to come up with a suitable plan of attack. We also regularly assess your strategy ensuring that it is fit for purpose and delivering the desired results.