- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

31st January 2024 – Property Market Update

January Market Smart – Perth, Adelaide and Brisbane Continue to Perform

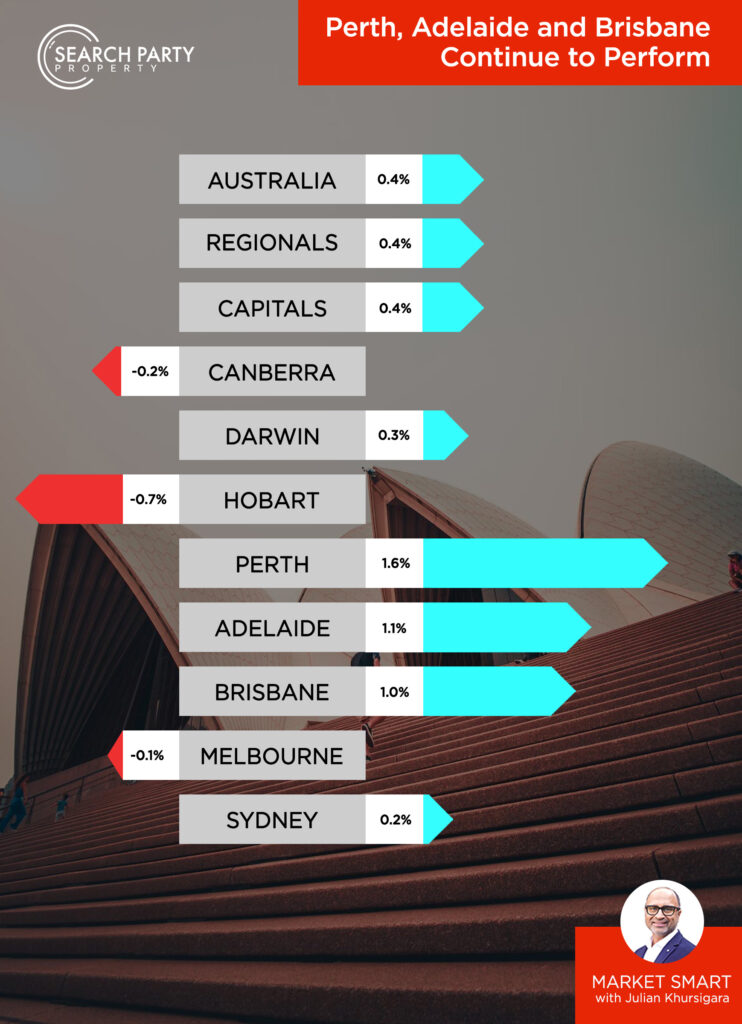

The Australian housing market has carried on its upswing into 2024. National dwelling values rose 0.4% increase in January marking a consistent, year-long rise in value. As we saw towards the end of 2023, Perth, Adelaide, and Brisbane have seen significant growth and continue to drive the aggregate figures as some other cities have experienced declines. Regional markets are also gaining momentum, outpacing the capital cities in value growth. Read on as we examine these trends more closely and discuss the important factors for investors to consider moving forward.

Where we are now?

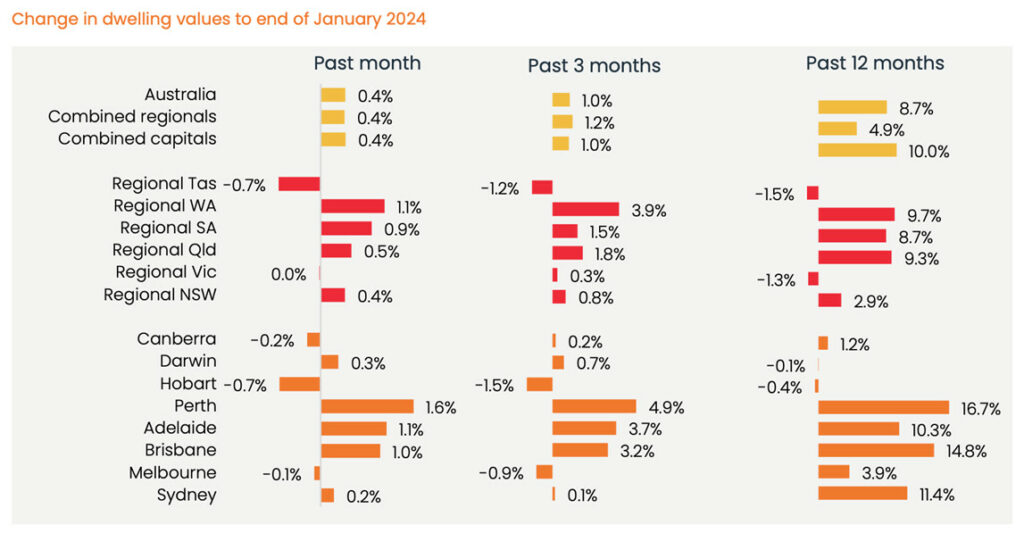

As discussed, there remains a significant level of diversity across national markets. While Perth (1.6%), Adelaide (1.1%) and Brisbane (1.0%) are the only cities that performed above this month’s overall 0.4% growth, Darwin (0.3%) and Sydney (0.2%) also experienced modest growth. Meanwhile, housing markets in Canberra (-0.2%), Hobart (-0.7%) and Melbourne (-0.1%) have all experienced varying degrees of contraction across January.

Source: CoreLogic, 2024

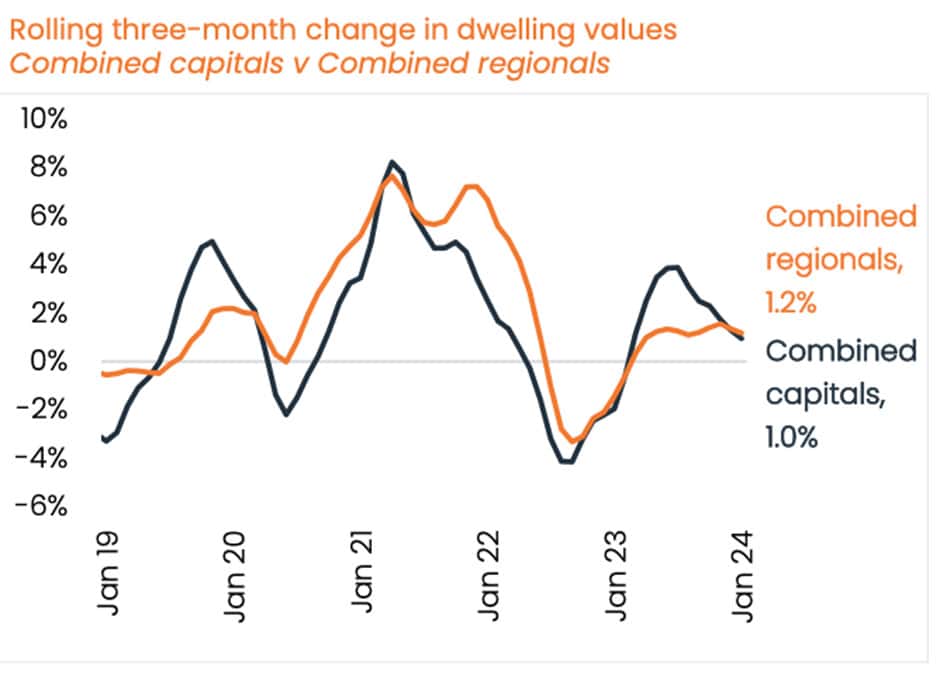

Interestingly, regional markets have begun to indicate stronger price momentum than capital cities. Despite matching the 0.4% growth of combined capitals in January, over a rolling 3-month period regional growth has outperformed the capital cities by 0.2%. This marks a departure from the norm, given that over a rolling 12-month period, capital cities (10%) have vastly exceeded the growth of regional markets (4.9%).

Source: CoreLogic, 2024

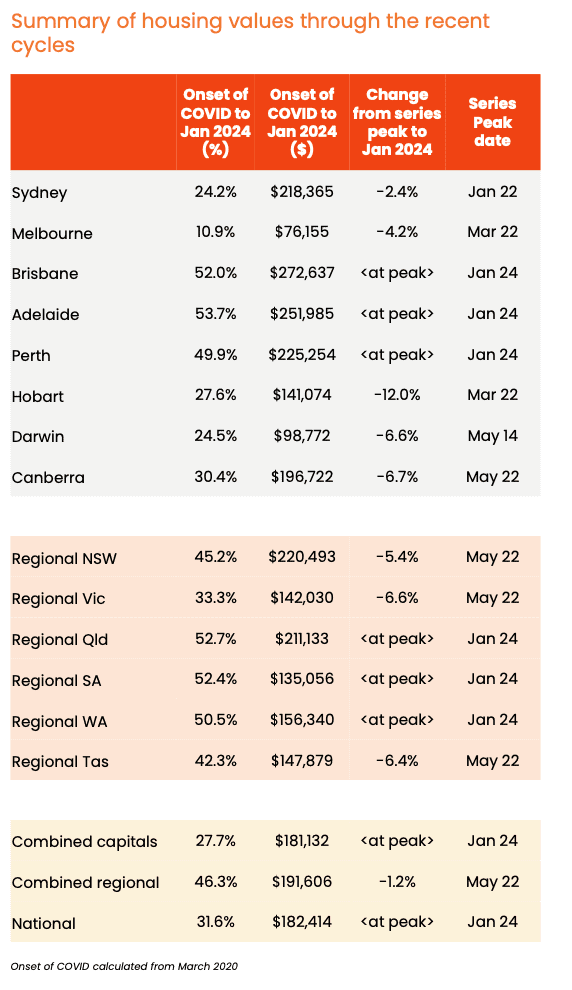

Looking again at emerging trends since the onset of COVID, results have remained relatively consistent since last month. Perth, Adelaide, and Brisbane remain the only capital cities at peak price levels. Brisbane, having added $272,637 since to median prices since the onset of COVID, has now grown to an overall median value of $796,818, lifting it above Melbourne’s median of $777,250, where prices have risen by just $76,155 across the same period. One caveat to this is that, taking units and houses separately, Melbourne retains higher median values in both categories. However, thanks to a greater proportion of units than in Brisbane, Brisbane has managed to achieve an overall higher median value.

Regional markets since COVID have also continued to track alongside the capitals, with regional QLD, SA and WA the only regional markets at peak price levels. However, unlike the capitals, combined regional markets remain 1.2% below peak price, with the top 3 performers failing to raise prices by quite enough overall. There also seems to be a lower degree of variance across the growth of regional markets (a spread of only 19.4% between regional VIC and regional SA) compared to that of the capitals (a spread of 42.8% between Adelaide and Melbourne).

Greater disparities also exist within the performances of some regional markets compared to their state capitals – for example Melbourne (+10.9% growth since COVID) vs regional VIC (+33.3%).

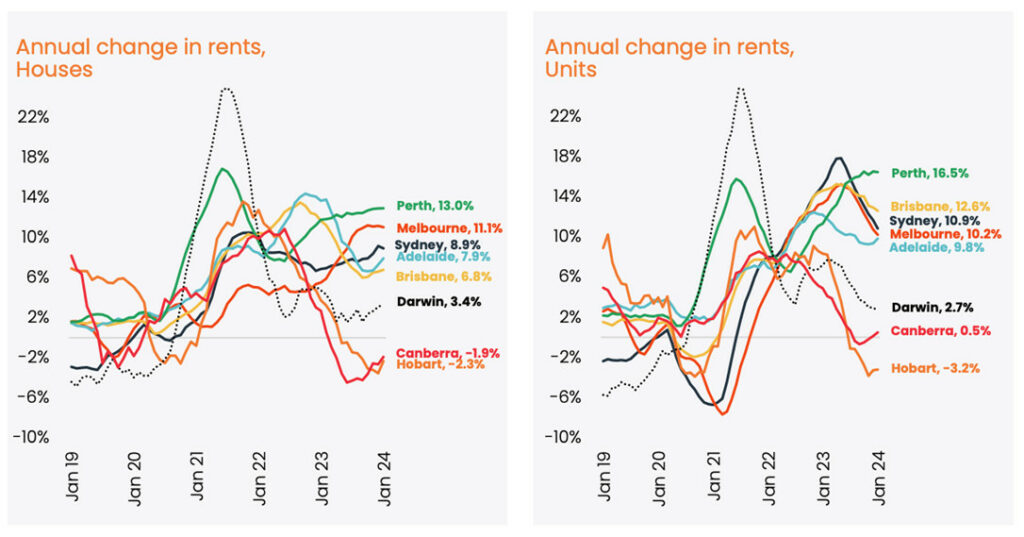

The 0.8% bump to the rental index in January was its strongest rise since April, and the typical early-year boost in rental prices is expected. Surprisingly, Melbourne and Sydney make it into the top three for house rent increases, despite being off the pace in terms of capital growth. For units, Sydney and Melbourne were third and fourth respectively for rent increases, while Perth topped both categories. Hobart was the only city to indicate falling rents for both houses and units, while only houses in Canberra experience a dip in rent.

How did we get here?

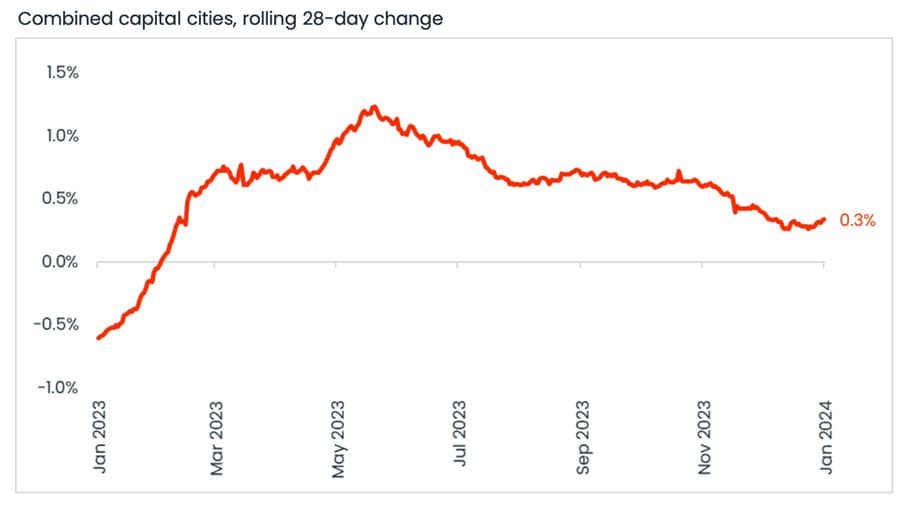

With the market having proven demonstrably resilient for some time, and no rate changes pending, January was likely to be a relatively consistent month. Taking a broad view, January’s price trajectory represents a plateauing of an overall decline in the pace of price growth since May:

There have also been some other notable developments:

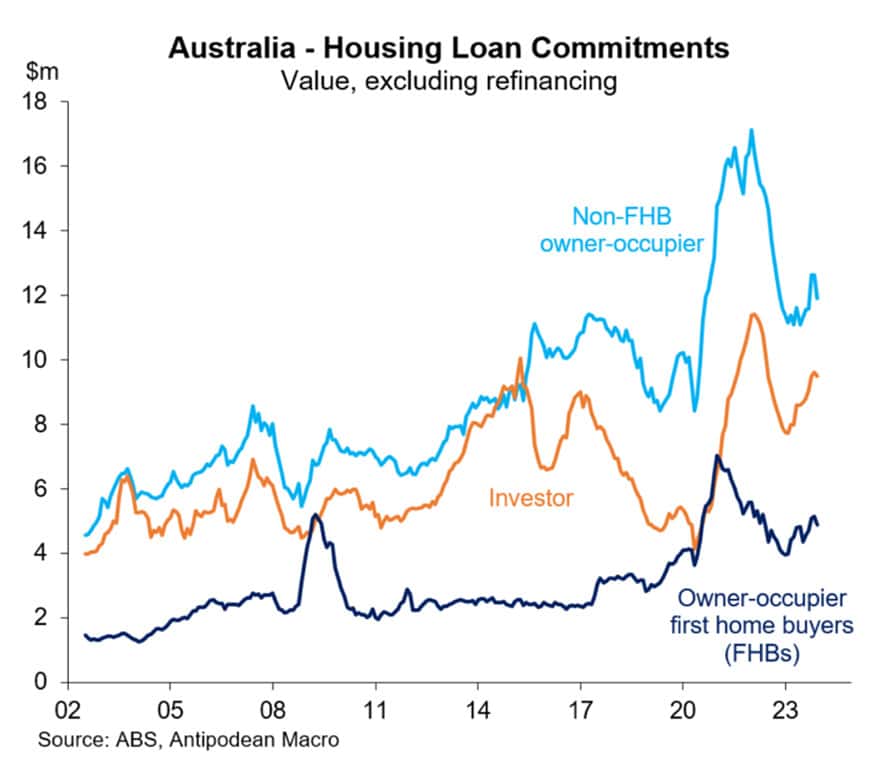

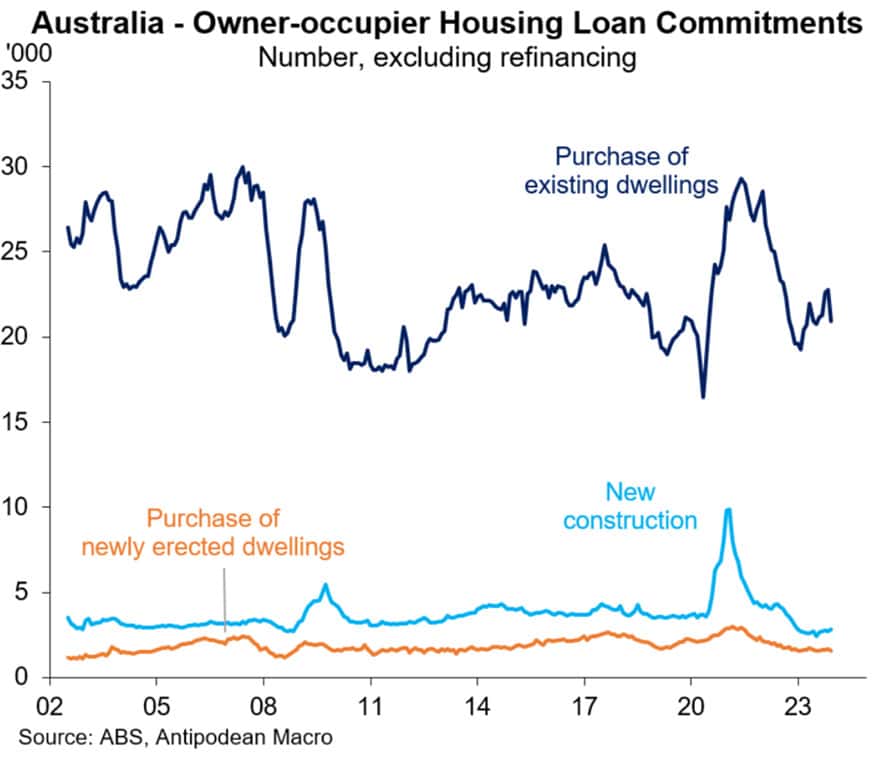

Tangible demand has begun to take a slight hit recently, as evidenced by the fall in the value of new housing loan commitments for both investor and owner-occupied properties. Similarly, volume also declined significantly for existing dwellings:

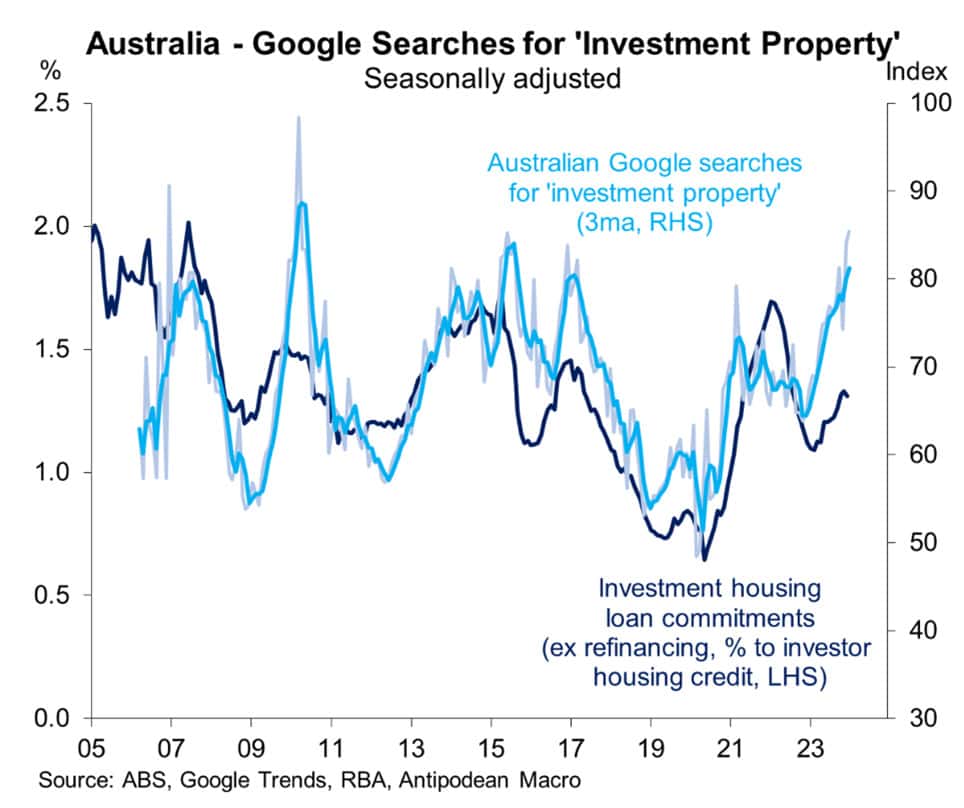

Strangely, this fall in the value and number of loans hasn’t been backed up by the continued surge in search interest for investment properties:

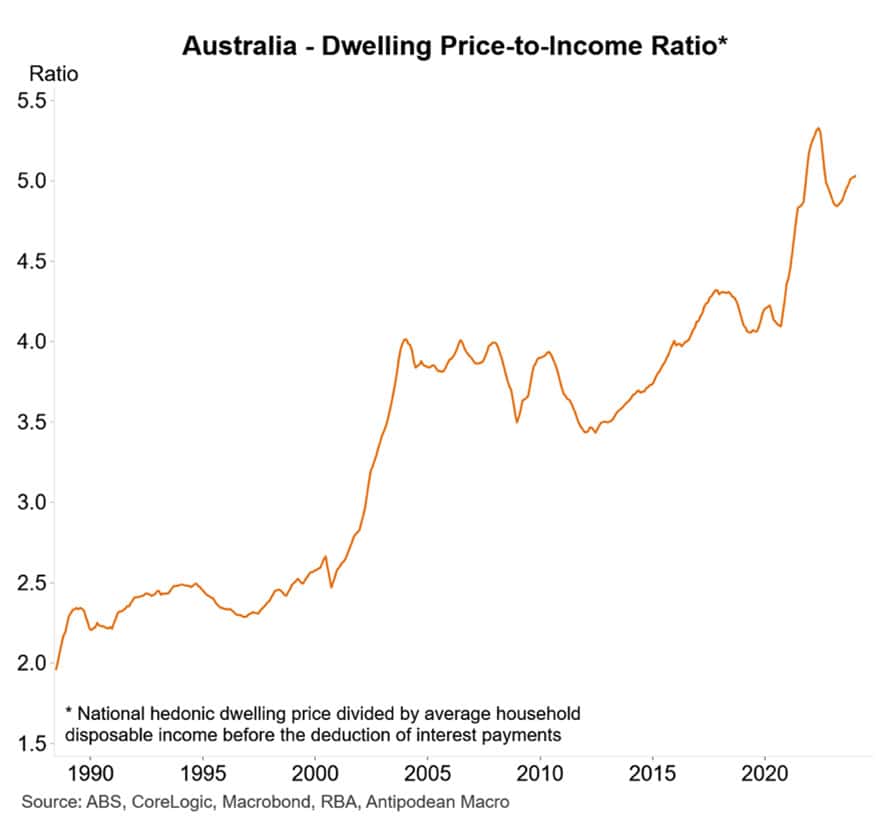

It’s difficult to reconcile these seemingly contradictory trends, but one explanation might be ‘pent-up demand’ – where a high level of underlying demand is constrained due to other factors like poor affordability:

Despite the ongoing affordability challenges though, and the decline in volume and size of loan commitments, sales volume has held above average (11.9% above this time last year and 0.5% above 5-year averages for January), which is again supporting price growth.

Where are we going?

Monetary policy remains key moving forward.

As many commentators have begun to point out, the narrative has started to shift from – ‘are rates high enough to bring inflation down?’ – to – ‘how long do rates need to stay as they are?’

We know that central banks will always err on the side of caution to avoid the embarrassment of reversing a policy decision, and as we explore in our article, the potential for the stage three tax cuts to act as economic stimulus will add to the RBA’s level of caution.

To be completely certain that a rate lift will not be premature, the RBA will be keeping a close eye upon services and rental inflation, which both remain higher than other categories.

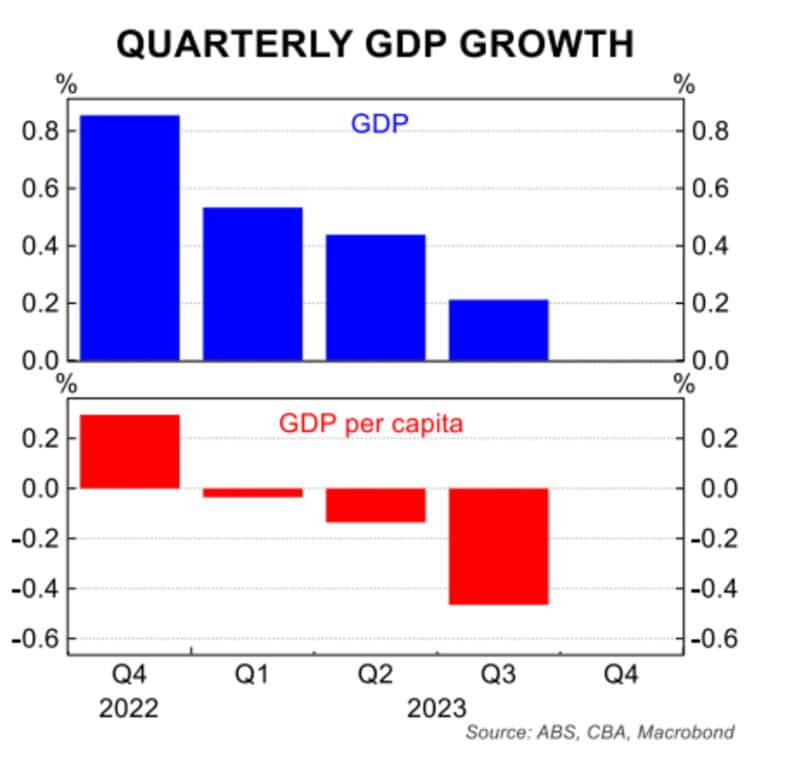

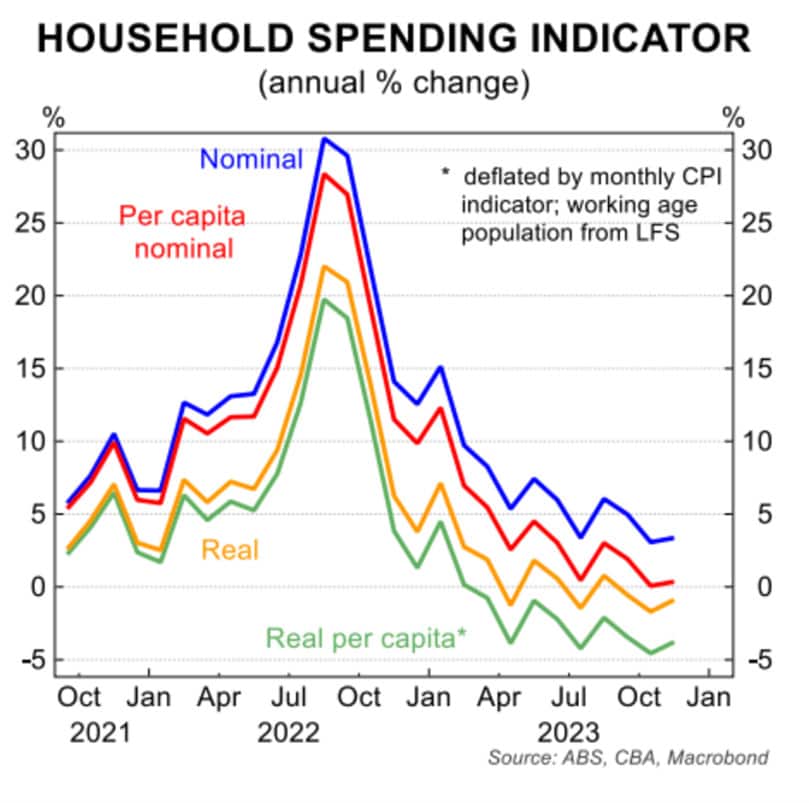

However, thanks to sluggish GDP growth, and low consumer spending, a further hike is unlikely.

Adding to the RBA’s concerns is that the country remains in a per-capita recession, as shown above. What that means is, though overall change in GDP has not been negative for two consecutive quarters, the growth has not been commensurate with growth in population.

In other words, the pie is getting bigger, but since more people have started eating it, everyone is getting a smaller slice. In effect, this means we are experiencing a recession, but population growth is propping us up. Looking at the above bar chart, you can see that GDP per capita has now been decreasing for three consecutive quarters.

It’s a complex set of factors for the RBA to grapple with as we rapidly approach the next announcement. The key takeaway though, is that a rate pause seems most likely for now, and a rate cut may yet be delayed further to later than expected in 2024 – where the pent-up demand for investment may at last take hold.

At Search Party Property, we specialise in developing tailored investment strategies and will work with you to come up with a suitable plan of attack. We also regularly assess your strategy ensuring that it is fit for purpose and delivering the desired results.