- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

31st March 2023 – Property Market Update

The Australian property market is making waves once again, rallying from a 10-month downturn.

Latest figures unveil a rise in aggregate home value indexes, ending a prolonged decline and sparking renewed interest.

Intrigued about the factors driving this change? Eager to understand the events that led us here?

Contemplating what’s in store for the future? Delve into our March Market Smart as we guide you

through the property market’s latest resurgence.

Where we are now?

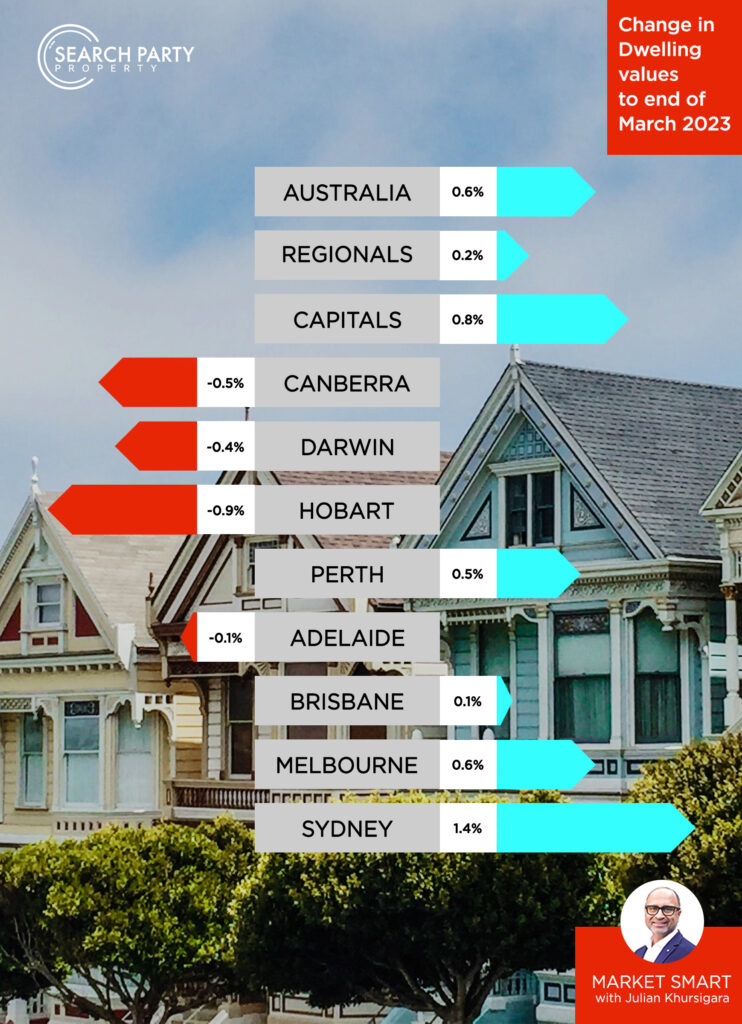

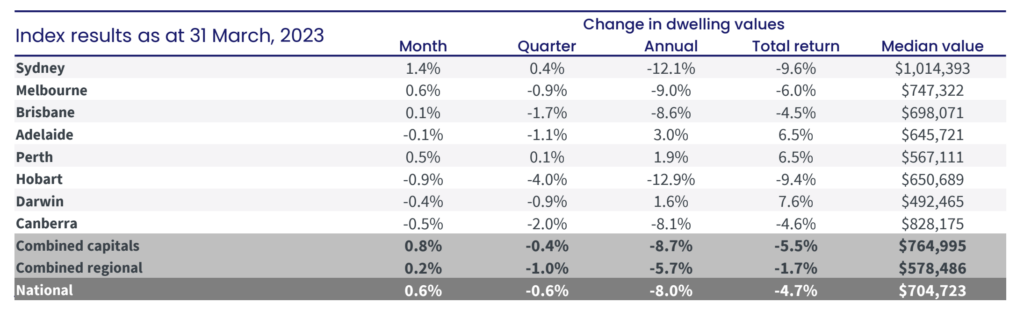

- 0.6% increase to national aggregate home values – the first rise in 10-months!

- Sydney (1.4%), Melbourne (0.6%) and Perth (0.5%) performing the strongest, Brisbane (0.1%) and Adelaide (-0.1%) experiencing relative stagnation.

- All capital cities have improved on quarterly figures.

- Despite continued declines in Hobart (-0.9%), Darwin (-0.4%), Canberra (-0.5%) and Adelaide (-0.1%), the rate of decline has slowed.

- Combined capital city growth (0.8%) continues to outperform regional growth (0.2%) in the short term, though capital cities are still losing out on an annual basis.

- Housing values in every state remain higher than pre-COVID levels (March 2020).

How did we get here?

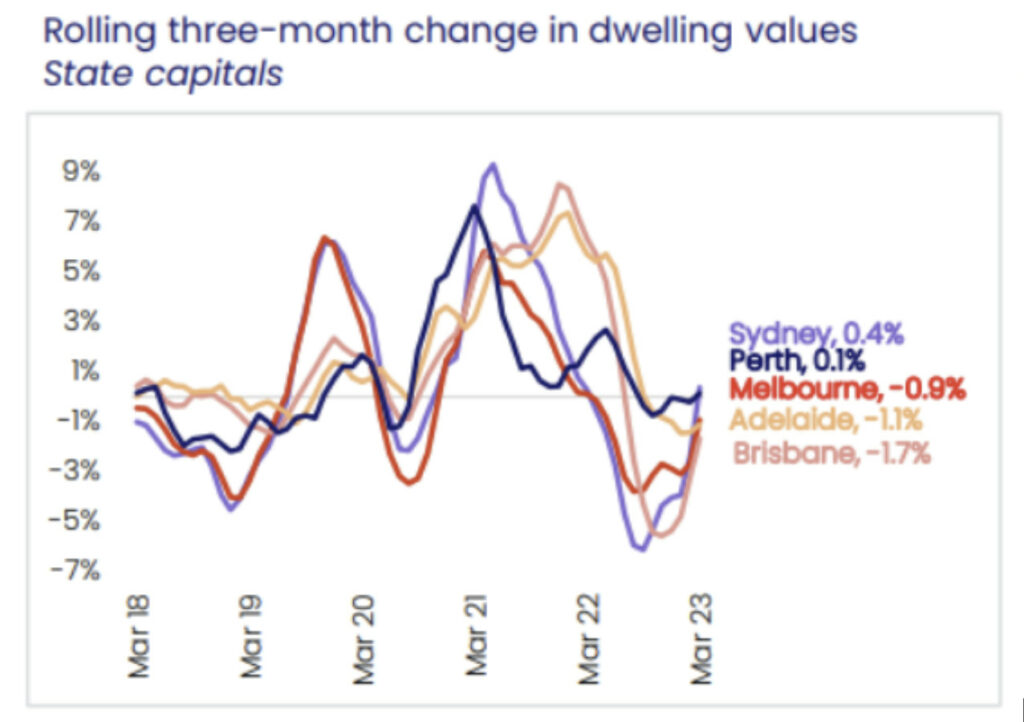

- Three month rolling averages have shown signs of recovery for some time (~late 2022).

- Melbourne, Adelaide, and Brisbane remain in decline across the past three-months.

- Sydney has demonstrated the most volatility, while Perth has been comparatively stable.

- Poor market supply (new listings 9.1% below 5-year averages) has not been compensated by a proportionate uptake in purchase activity, which remains relatively low (7% below 5-year averages). This low supply is driving the upwards pressure on prices, almost paradoxically, despite low overall activity.

- The difference between 2022 and 2023 figures began to close towards the end of March.

- 5-year averages and 2022 figures suggest that supply levels may again continue to fall until October this year.

- Extremely low rental vacancy rates and high immigration numbers are likely to be creating some overflow into purchase markets, which could exacerbate the impact of low supply on prices.

Will this growth last?

Probably… but here are a few things to consider:

1. Lag in the effect of interest rate rises:

Despite the RBA’s recent rate pause, it may take several months before the effect of the highest cash rate since 2012 will fully takes hold. 30% of existing home loans remain on fixed rates, meaning that a surprisingly high number of debtors are also yet to be exposed to higher interest rates.

2. Extremely tight credit supply, limiting demand:

With higher interest rates comes more stringent borrowing capacity assessment, and consistent rate hikes over the past year have reduced average household borrowing power by hundreds of thousands of dollars. This will limit the demand for real estate and ease upwards pressure on prices.

3. Poor consumer sentiment:

Despite being driven in large part by economic indicators, consumer sentiment is often reliably indicative of long-term market performance. Currently, the Westpac-Melbourne Institute Consumer Sentiment – “Time to buy a dwelling” – Index has fallen to an extreme low of 65.7. This is the weakest rating since 1989, when interest rates where at 17%. Furthermore, it seems as though this is being driven by expectations of looming price growth and a decline in affordability. The Westpac-Melbourne Institute House Price Expectations Index is now firmly in the ‘net-positive’ territory, at 111.7.

4. Interest rate expectations:

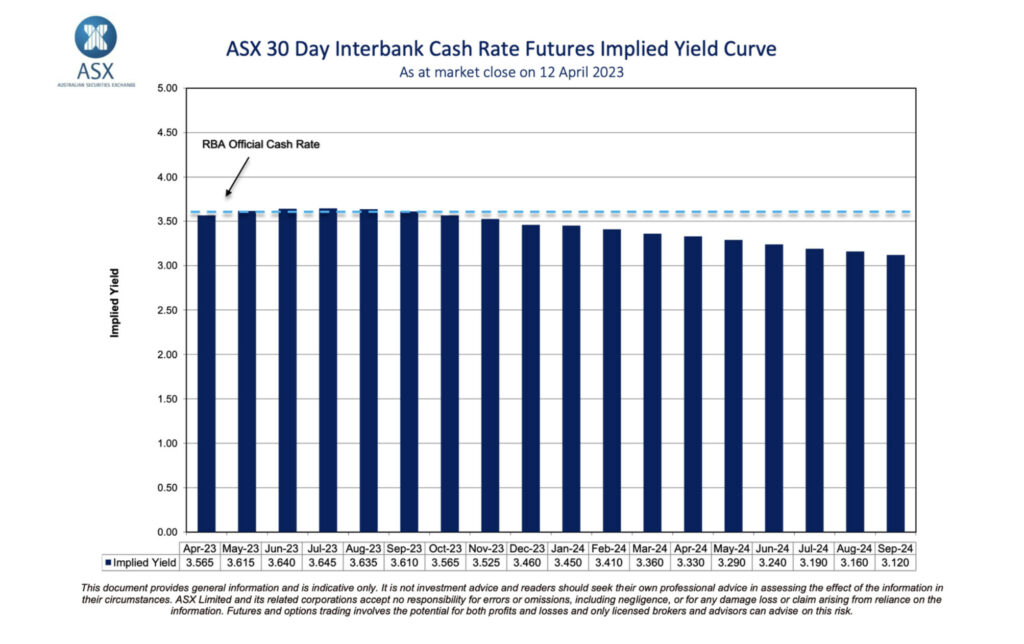

It remains to be seen whether the RBA will pursue subsequent rate adjustments throughout the latter half of 2023. Cash rate futures are forecasting an expected peak mid-year at around 3.645%, with a continuing decline across the remainder of 2023. This represents a tempering of expectations from just a few months ago, where markets were anticipating a peak closer to 4%.

5. Lingering effects of inflation:

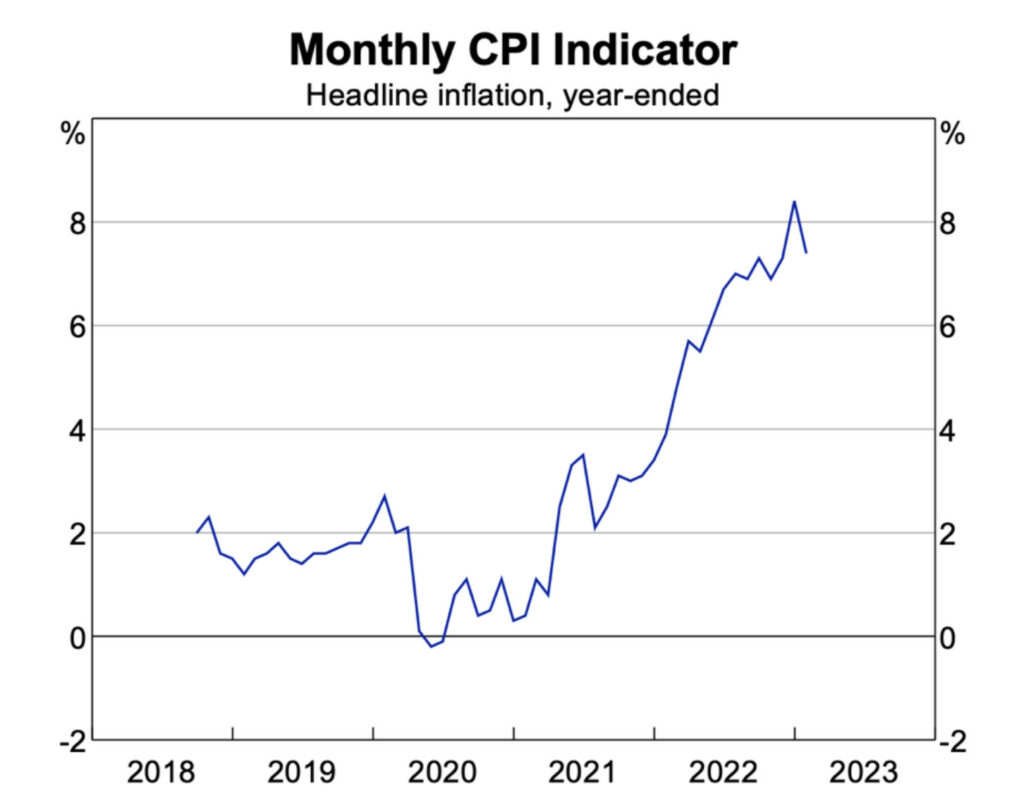

Inflation remains well above RBA targets despite the first indications of decline arising in early March. Due to a variety of global factors, it seems likely that ‘sticky’ inflation (perhaps settling at around 5% in Australia) may become a trait of the global economy for the foreseeable future. RBA estimates do not predict a return to target inflation (2-3%) until mid-2025. This will have significant and lasting implications for real estate markets, with households both spending and saving less.

Despite the potential challenges and uncertainty ahead, it’s clear that the Australian property market is showing promising signs of recovery. Here at Search Party Property, we are well-equipped to help clients navigate this changing landscape and make data-driven, informed decisions about their property purchases. If you’re looking to enter the property market, get in touch with us today to discuss how we can help you achieve your goals.

Suburb Spotlight – Lawnton

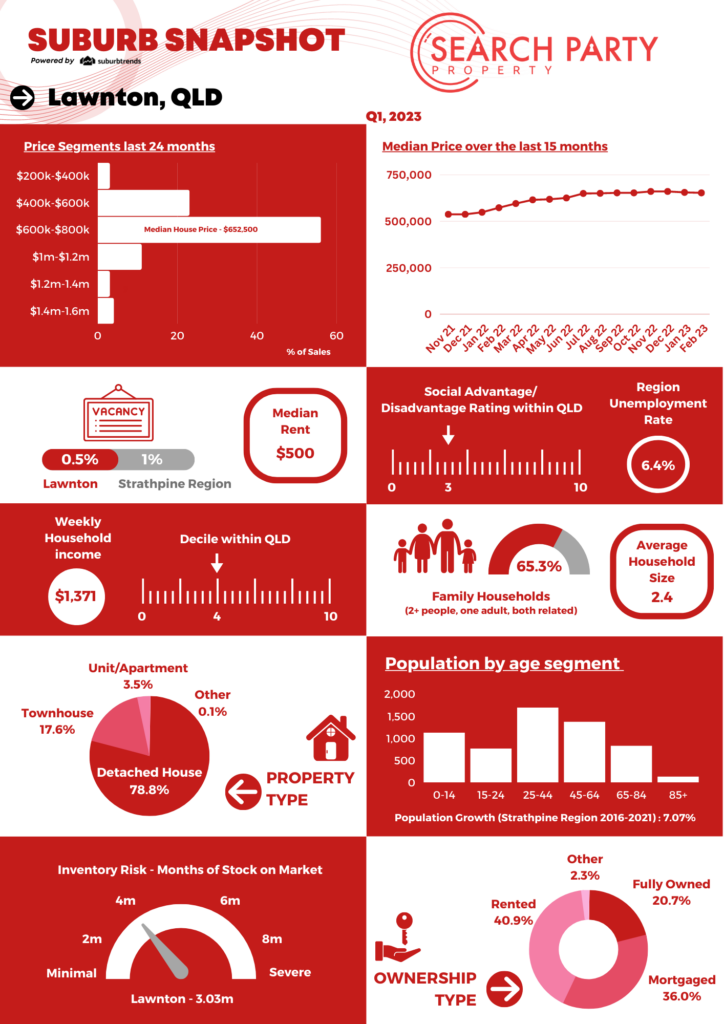

In this month’s Market Smart, we’ve chosen Lawnton, QLD as our spotlight suburb, to highlight its exceptional investment potential. Lawnton’s median house price stands at $652,500, while the median rent comes in at $500. With a low vacancy rate of just 0.5%, Lawnton presents a compelling opportunity for investors.

The suburb boasts a diverse age demographic, a growing population and healthy rental demand. Lawnton’s combination of growth and stability make it an ideal candidate for further exploration. Get in touch today to secure your next investment property in this flourishing suburb!

At Search Party Property, we specialise in developing tailored investment strategies and will work with you to come up with a suitable plan of attack. We also regularly assess your strategy ensuring that it is fit for purpose and delivering the desired results.