- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

August 2021 – Property Market Update

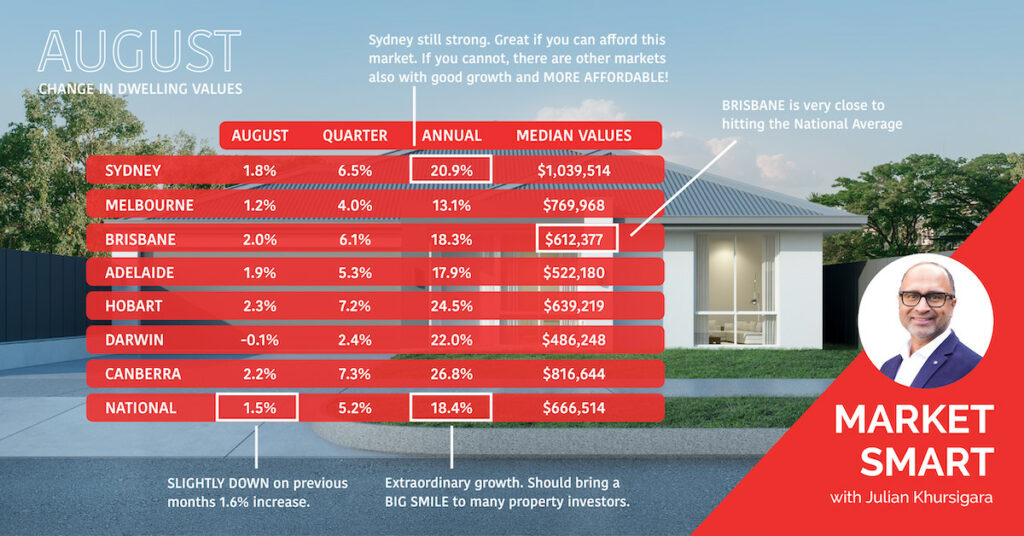

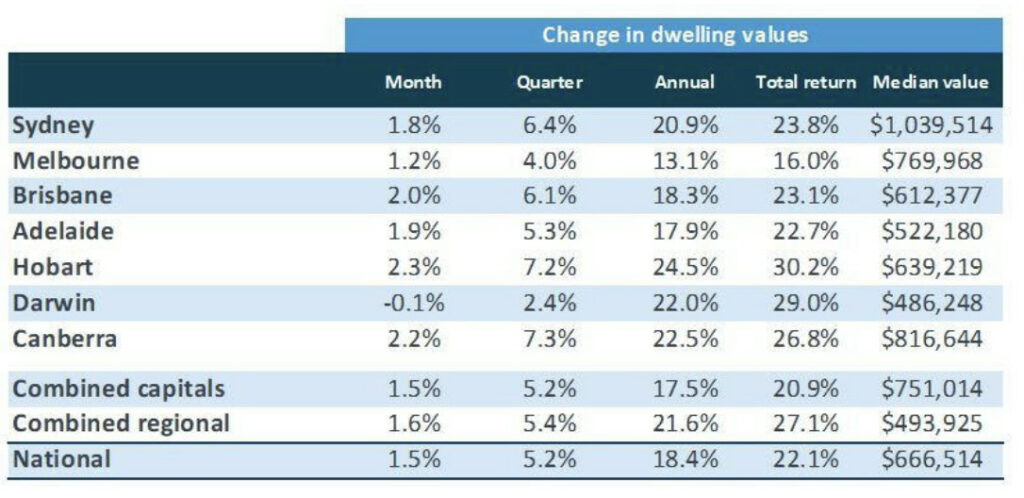

The property market has once again largely defied the potential negative impact of lockdowns, with property values increasing 1.5% over August. This is slightly down on last month’s 1.6% rise and is the smallest monthly increase since January. However, it remains well above the long-term average.

Interestingly, some market watchers believe the ongoing restrictions in NSW and Victoria may be indirectly bolstering property values. Noting the clear connection between lockdowns and reduced listing volumes, they suggest that limited supply is driving current price growth. What’s more, some say this is helping counteract growing concerns over affordability.

Either way, growth may be slowing, but prices are still up 18.4% when compared to last year. In real terms, this represents an increase of about $103,400 over the last 12 months – or around $1,990 a week.

Source: Core Logic

As you would expect, exact performance varies across the different markets, with Melbourne somewhat lagging behind, up 13.1% YoY. Smaller capital markets, like Canberra and Darwin, are continuing to lead the charge, up 22.5% and 22.0% YoY, respectively. However, the Darwin market appears to be cooling and was the only capital to record negative price growth over August.

Regional markets continue to hold up well, narrowly outperforming the capitals on a combined basis.

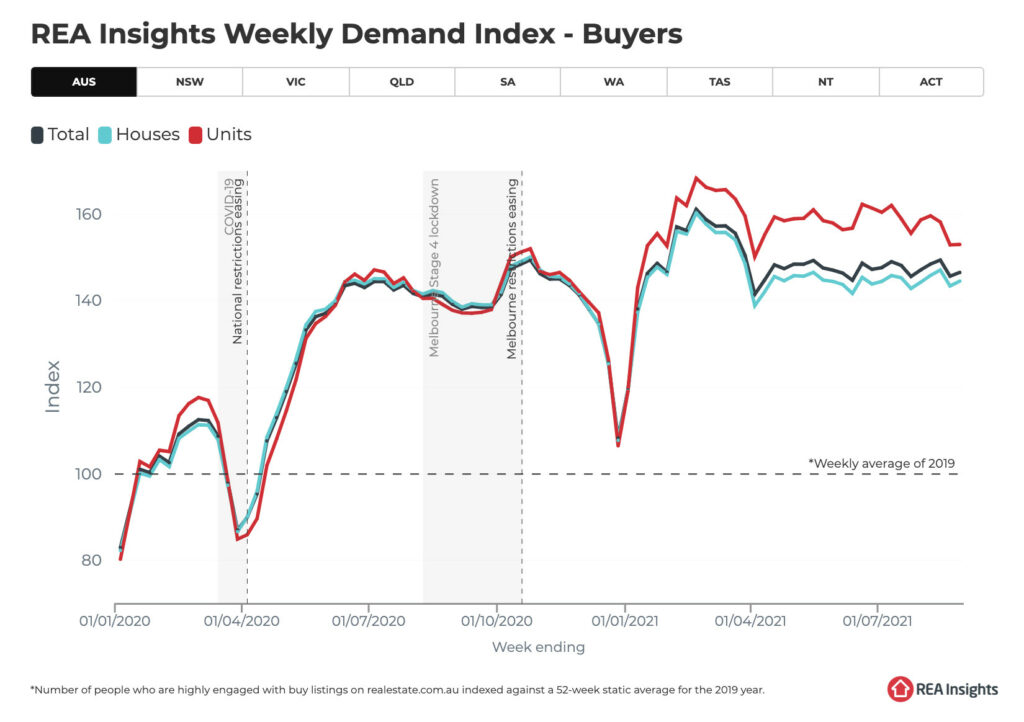

Buyer demand has remained strong, continuing to hover within 10% of the record high levels recorded in February. Once again, exact performance varies from market to market, with Sydney recording the strongest increases over the last few weeks. This represented a bounce back from the sharp falls seen across the first half of the month.

It is also worth noting that, since the start of the year, demand for units has increased more than the demand for houses. This is being driven by the growing number of first home buyers entering the market and increased interest from investors. However, increased demand is not necessarily translating to increased value, with house prices significantly outperforming unit prices over the same period.

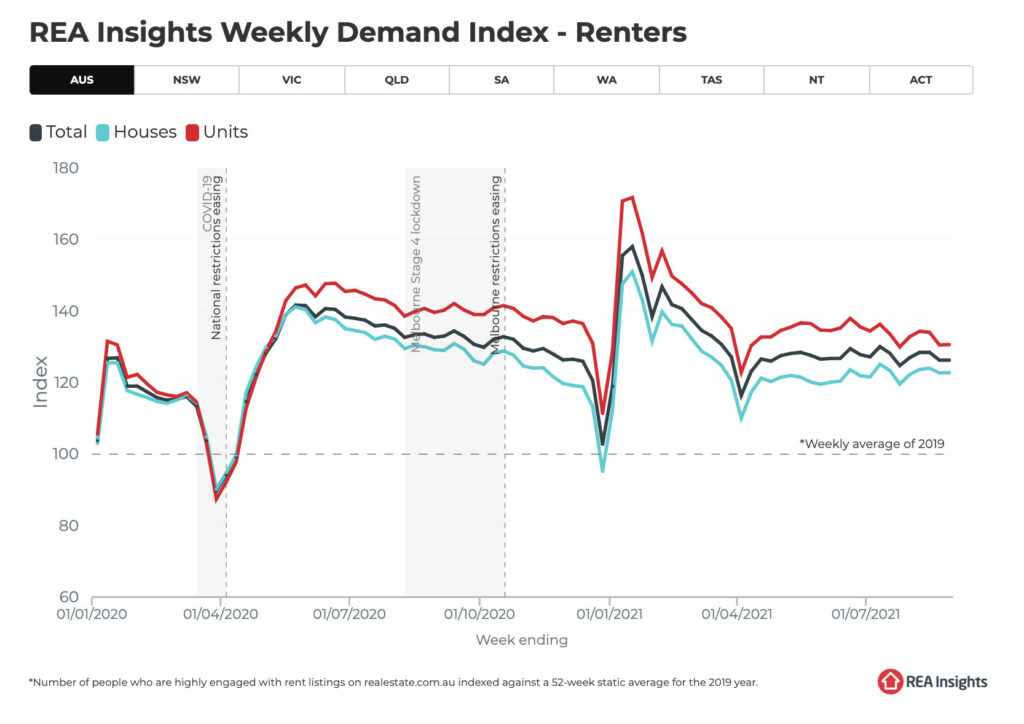

Demand for rental properties also remains strong, still sitting about 25% above the 2019 average. That being said, aggregate levels are slightly down when compared to the same time last year and 20% lower than the January peak. This is mostly due to the increased market volatility caused by the ongoing lockdowns.

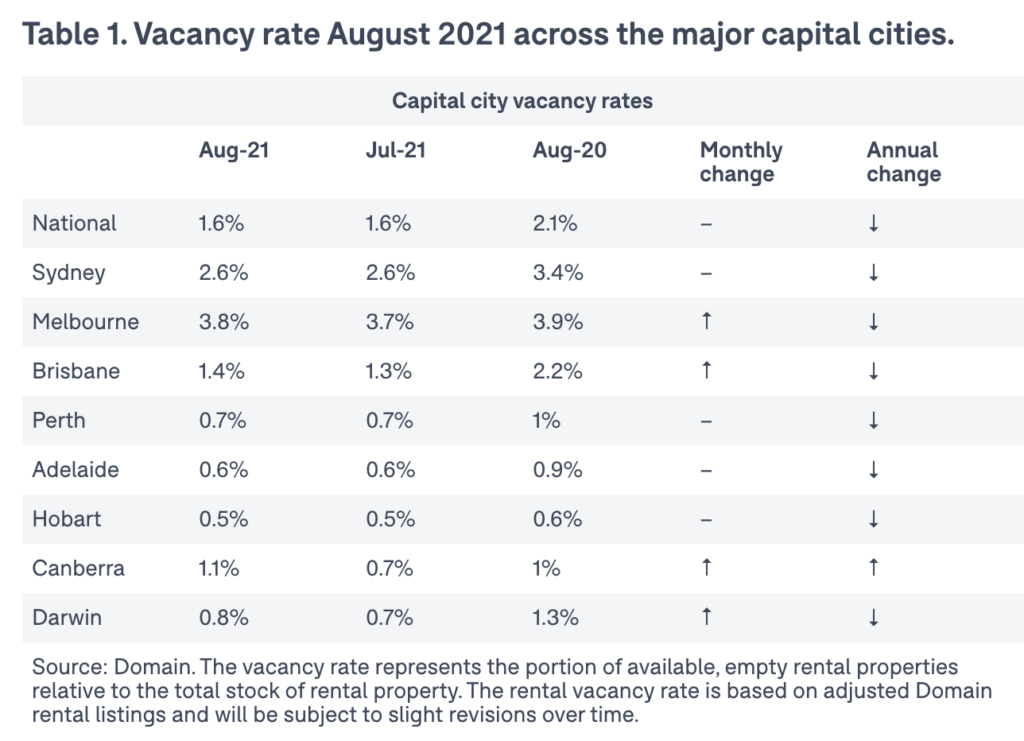

The good news is this slight slowing in demand is not having a major impact on vacancy rates. While about half the capitals have seen an increase over the last month, this has been quite modest (generally 0.1%). There is also only one market (Canberra), with a higher vacancy rate than at the same time last year.

Expectations for the Month Ahead

While the property market is still reasonably volatile (particularly NSW and Victoria), there are a few clear trends emerging. As such, over the next month we expect to see:

- Sales continue to be deferred: One of the main issues impacting the supply of new listings is the hesitancy to sell during lockdowns. Instead, many homeowners are choosing to hold onto their property, deferring their sales campaign until after restrictions are lifted. And, with several states now openly talking about their timeline for reopening, we expect many buyers will be content to wait.

- Property values continue to increase: There is no denying that price growth is slowing, but the market is still quite strong. As such, we expect to see another month of positive results for property values, with gains likely hovering around 1%.

- Units continue to close the gap on price performance: While it is highly likely that houses will continue to outperform units, the gap is closing. And, with buyer demand for units comfortably outstripping the demand for houses, it is only logical prices will eventually follow. As such, we expect the gap between house price and unit price increases to close over the coming months.

Suburb Spotlight: Cessnock (NSW)

Situated in the Hunter region, Cessnock is a small inland city and the administrative centre of the City of Cessnock LGA. It is located 152km North of Sydney, 52km West of Newcastle, and 27km South-West of Maitland. It is also the largest town in Australia’s oldest wine growing region, the Hunter Valley.

Cessnock was once widely known as “The Coalfields”, thanks to the large amount of mining activity in the area. However, this has declined significantly over the last few decades and the city has undergone a major change. As a result, it is now most known for good food, great wine, and unique tourist experiences.

This transformation has also had a major impact on the property market, with Cessnock now providing plenty of investment potential. With a median price of around $450k for houses and $325k for units, property in the area is still reasonably affordable. This is despite price increases of over 18% and 7.5% (respectively) over the last 12 months.

Importantly, Cessnock is also popular with renters, with just under a third of residents living in a rental property. This, combined with a vacancy rate currently sitting under 0.7%, suggests that the local rental market is strong. As a result, if you are considering investing in Cessnock, you can expect to receive an annual return of around 4.5%.

At Search Party Property, we specialise in developing tailored investment strategies and will work with you to come up with a suitable plan of attack. We also regularly assess your strategy ensuring that it is fit for purpose and delivering the desired results.