- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

Can You Predict Interest Rates?

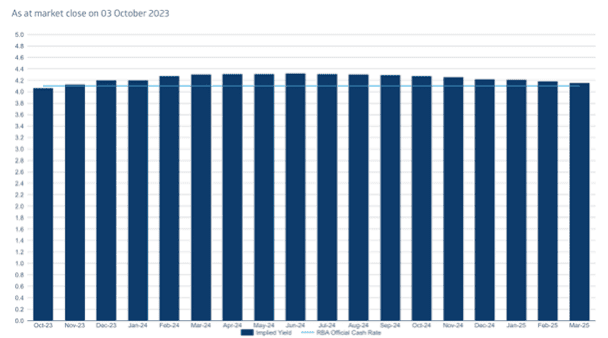

If you keep up with our monthly Market Smart reports at all, you’ll have come across one of these charts:

This is the ASX’s “30 Day Interbank Cash Rate Futures Implied Yield Curve”, and, as well as having an egregious word salad of a name, it can be a pretty useful tool for understanding what the RBA is likely to do with interest rates.

How? Well, the key concept at play here is in the title – “futures”.

Futures are a clever type of financial contract that can help to hedge against risk. To explain, let’s take a quick example:

Imagine you’re a farmer who grows apples. For a variety of reasons (say, new competitors, weather, anything really) you’re worried that when it’s time to sell your apples in a few months, it looks like prices are going to be lower than normal, and you’re heading straight for a loss.

However, fortunately for you, there just so happens to be a juice maker down the street. He has to buy apples for his juice and, it turns out, he seems to be thinking the exact opposite – that come picking season, he thinks apple prices will probably be higher than normal.

So, it makes sense for both of you to make a deal now at an agreed price. You promise to sell, and the juice maker promises to buy your apples at the fixed price when they’re ready. This way, you both are protected from unexpected price changes. You know the price in advance, and it won’t change no matter how the market prices fluctuate. Both of you have reduced your level of risk.

In the same way, futures contracts can be written for almost anything. Apples, livestock, oil, stocks, cryptocurrencies, carbon credits – anything that can be bought and sold can have a futures contract attached to it.

The key concept is simply that you’re agreeing a price now with another party, for a transaction that will take place in the future.

These same contracts can also be written regarding the cash rate set by the RBA, though the process is a little bit different in execution.

The ASX creates and sets prices for futures contracts as the ‘futures exchange’ (the marketplace for futures). Then, (simplifying the process somewhat) investors can either go long (bet that the cash rate will increase) or go short (bet that the cash rate will decrease) through these futures contracts. Often, banks are the ones placing these bets. Since the cash rate directly affects their costs, placing bets on the direction of the cash rate can be a great way for banks to control their risk.

Simply put, the ASX is operating a betting market for the cash rate and with a look at the direction of the bulk of the betting, the ASX can calculate an ‘implied yield’ – in other words, what the market expects the cash rate to be down the track. This is what can then be plotted on a chart.

So, in theory, the chart with the ridiculous name (“30 Day Interbank Cash Rate Futures Implied Yield Curve”), should simply tell us what the most popular expectations for the cash rate are over time. The columns of the chart represent an average of the bets that banks and other investors are making.

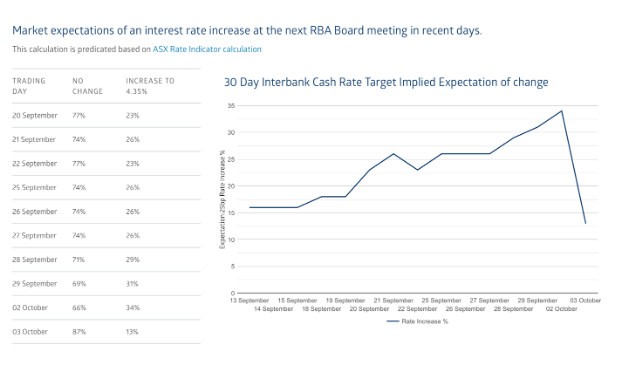

Interestingly, the ASX also publishes another interpretation of these figures, presented as the pure percentage chance of a rate change:

The line chart on the right here indicates the expected probability of a rate rise (based upon futures contract betting) in the lead up to the RBA’s announcement on the 3rd of October, where rates were held stable at 4.1%.

Of course, charts like these are not infallible, and it should be stressed that these predictive tools are simply probabilistic measures of broad sentiment. Ultimately, the cash rate is still decided by a small group of people, upon which these figures have no bearing. However, these are certainly useful tools that can help to paint an understanding of collective expectations and where things are likely to head, in combination with other data.

If you’re curious about what might happen to interest rates down the track, to help inform your property investment decisions, you might like to look at the up-to-date charts!

https://www.asx.com.au/markets/trade-our-derivatives-market/futures-market/rba-rate-tracker

Want to discuss this further?

For expert guidance in property strategy, and what it could mean for you as a property investor, book in for a free consultation to make informed decisions, tailored to your investment goals. Don’t let affordability challenges hinder your success. Act now with Search Party Property!