- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

Central Bank Digital Currencies are here. What do property investors need to know? (Part 1)

When was the last time you paid for something with cash?

Chances are, it may have been a while!

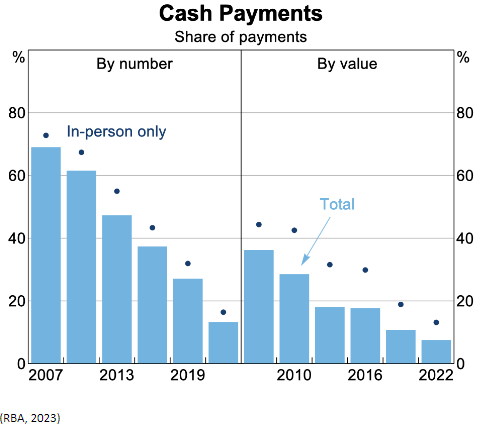

The share of all transactions conducted in cash has been in a steady decline for decades:

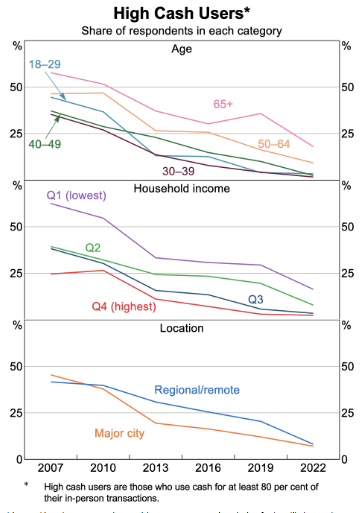

This trend is only set to continue, with younger generations being far less likely to rely upon cash for the bulk of their purchases.

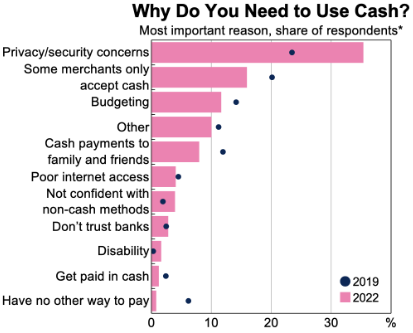

Those who do still rely on cash, do so for a variety of reasons – chief amongst them being privacy concerns:

But, for the overwhelming majority of Australians, the convenience and simplicity of digital private bank money cannot be beaten. It’s never been simpler to receive funds, manage your money, and make online or in-store purchases with just a wave of your phone.

Since the early 1990s, the advent of digital money has been truly revolutionary –but increasingly, it looks as though the next money revolution is just around the corner.

They’re called Central Bank Digital Currencies (CBDCs), and after years of quiet development, Australia’s own CBDC could be just a few years away.

In part 1 of this article series, we’re taking a brief look at what CBDCs are, what Australia’s own CBDC might look like and what the potential benefits of CBDCs could be. In part 2, we’ll look exclusively at what property investors need to know about the emergence of CBDCs, and how they could impact the real estate industry more broadly.

What is a CBDC?

Most people understand that one of the Reserve Bank’s responsibilities is the issuance of our physical money – our coins and notes. This is conducted via the Royal Australian Mint, which carries out the physical creation of these coins and notes according to the RBA’s orders.

(Canberra Times, 2018)

However, what you may not realise, is that the funds you see displayed in your online bank account are different. While still being legitimate money, this money is not issued by the Reserve Bank, it’s instead issued by the private bank where your account is held.

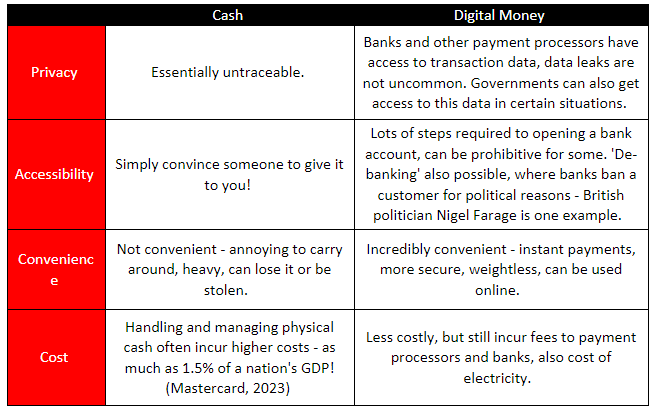

A CBDC then, in simple terms, combines some of the traits of physical money and digital money, to become a new form of digital money issued by the Reserve Bank itself – a middle ground of sorts between what we already have:

Practically speaking, a CBDC available for consumers would probably look like a normal bank card or banking app on your phone, but one created and managed by the Reserve Bank. In fact, the RBA has been investigating an ‘eAUD’ (electronic Australian Dollar) since at least 2017, and already, a wholesale eAUD has been made available to a select group of big banks and financial institutions, including Westpac, CBA, and ANZ. In August this year, the RBA published the results of the CBDC pilot project, exploring potential use cases for an eAUD.

But of course, this all begs the question – why is everyone so interested in this?

What’s wrong with the system we already have?

To answer that, we need to compare our existing cash and digital money in a few important categories:

Clearly, in some ways (privacy and accessibility), cash is king.

In other ways (convenience and cost), digital money has the advantage.

Like we’ve mentioned, the theory is that by being a middle ground between cash and digital money, a CBDC can possess the best attributes of both:

- Privacy

Since in theory, reserve banks doesn’t have the profit-seeking motives of banks and payment processors, consumers can avoid leaving a digital trail that private entities or malicious actors might wish to sell or exploit. However, of course, CBDCs can’t quite replicate the complete anonymity of physical cash, as they would still generate a digital footprint and require oversight by central banks, law enforcement, and private service providers.

- Accessibility

In democratic nations at least, CBDCs could offer greater protections in terms of access to banking services – being a government managed service rather than one administered by private companies with the power to ban customers.

- Convenience

CBDCs promise all the conveniences of digital money, and then some. There has been considerable discussion of CBDCs being implemented alongside a blockchain system, which could facilitate significant advances in terms of security, convenience, transparency, and functionality.

Alongside faster processing times and ease of interaction with other publicly traded cryptocurrencies, a blockchain CBDC could make use of a technology known as a ‘smart contract’. In essence, a smart contract means that you can program your money to act as its own decentralised and automatic escrow service.

For example, suppose you wanted to hire a graphic designer to create a business logo – a smart contract might work like this:

- You both agree that upon the delivery of a logo that satisfies the set specifications within a fortnight, the designer will be compensated with $200 of eAUD.

- When the designer submits the finished logo to the predetermined digital location, it triggers the smart contract’s verification mechanism.

- If the submission aligns with the contract’s stipulations, including timely delivery and, if required, your approval, the smart contract automatically processes the payment to the designer.

- Conversely, if the designer failed to meet the submission deadline or the work does not match the agreed specifications, the smart contract ensures that your funds are returned to you.

This automated system engenders a trustworthy and transparent transaction between parties, without the need to pay for a third-party escrow service.

- Cost

Like digital money, a CBDC avoids the significant costs attached to cash, while potentially also reducing costs associated with escrow services or secondary payment processors like PayPal. For the big banks in particular, CBDCs could save up to $3bn per year in global cross-border payments alone.

(Thanks for reading, and check for Part 2, where we’ll explore what an eAUD might mean for property investors!)

Want to discuss this further?

For expert guidance in property strategy, and what it could mean for you as a property investor, book in for a free consultation to make informed decisions, tailored to your investment goals. Don’t let affordability challenges hinder your success. Act now with Search Party Property!