- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

Could rate hikes be missing the point?

Are you feeling the pinch of rising interest rates in the property market?

The RBA’s ongoing rate hike cycle has sent shockwaves throughout the economy and sparked broader debate regarding the effectiveness of their monetary policy approach. In the March edition of Deloitte Access Economics’ Business Outlook report, author Stephen Smith was critical of the RBA’s strategy, arguing that a traditional rate hike approach is not the answer to what is currently driving inflation.

In this article, we investigate what inflation is, discuss what makes it so difficult to solve, and examine whether our friends at Deloitte may have a point!

Types of Inflation

As we all know, inflation is defined as a rise in the cost of goods and services over time.

But importantly (getting a bit more technical here…), there are really two forms of inflation! These are:

- Demand-Pull Inflation

- Cost-Push Inflation.

First, demand-pull inflation occurs due to an increase in demand, relative to supply, as shown here:

From where demand and supply intersect at state 1, an increase in demand changes where demand and supply intersect, creating a higher price level. You can see this change reflected in the new intersection of the red demand curve at state 2.

This type of inflation is often the result of a booming economy with a high level of consumer confidence – you may notice that it occurs alongside a rise in economic output!

This is also really the only kind of inflation that an RBA rate hike can prevent. The idea is that by making lending more expensive, a general rise in demand can be avoided, and inflation will be prevented.

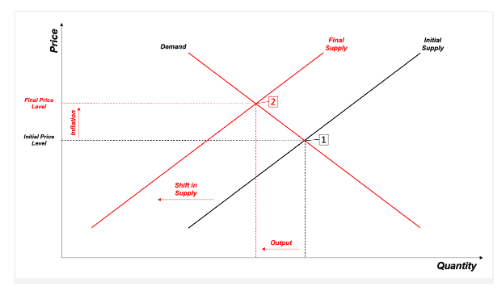

Secondly, is cost-push inflation, which occurs due to a dip in supply relative to demand, shown below:

Like demand-pull inflation, cost-push inflation does create a higher price level, but at the same time decreases economic output.

Currently, this is the primary concern for the RBA. The major causes of Australia’s recent inflation are disruptions to supply chains and rising energy prices, stemming from both the pandemic and the Ukrainian conflict.

As we know, the RBA has raised interest rates to combat this inflationary pressure, in the hope that higher borrowing costs will reduce demand and stabilize prices.

However, Deloitte’s Stephen Smith has argued that interest rate hikes may not be the most effective tool in combating cost-push inflation. He suggests that the RBA should have paused earlier in its interest rate-hiking cycle, rather than waiting until April.

So, is he right?

While it is true that rate hikes are better suited to combatting demand-pull inflation, it’s important to remember that different kinds of inflation do not occur in isolation. Had rate hikes not been used to stifle demand, existing inflation (driven primarily by cost-push and supply factors) could have become a lot worse.

Moreover, given that the full effect of the rate hike cycle remains to be seen (see our March Market Smart for more) it’s difficult to conclusively evaluate the RBA’s monetary policy approach thus far. We have seen inflation begin to come down from its 2022 peak, falling as low as 6.8% in March this year. Though a return 2 to 3% target inflation would appear to remain some way off in any case.

What does remain true, is that the RBA is facing a difficult balancing act trying to keep a lid on inflation driven by factors beyond their control, without unnecessarily restricting economic growth and placing undue strain on consumers. They just don’t quite have the right tool for the job – sort of like trying to hang a picture with a sledgehammer.

Want to discuss this further?

When it comes to property investing it’s always important to understand the factors shaping our economic climate. At Search Party Property, our team of experts are always eager to help you navigate the uncertainty and achieve your financial goals. Schedule a Discovery Call today and discover how we can leverage our skills and industry experience to assist you on the path to financial freedom.