- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

Stage 3 Tax Cuts – Good news for property?

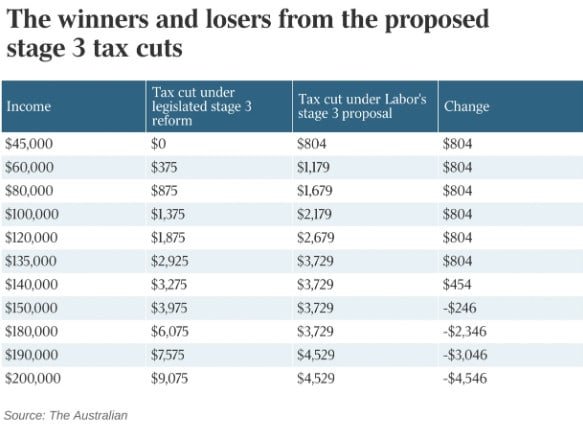

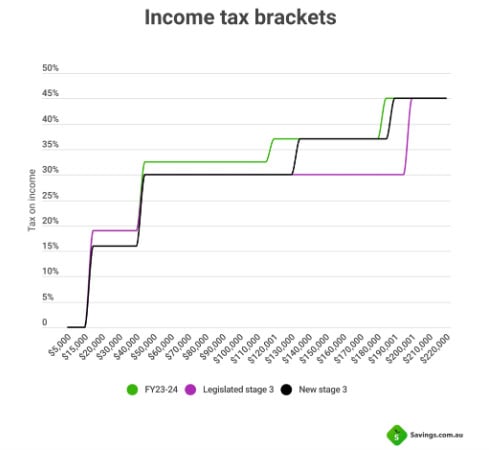

Recently, the Labor government has announced new changes to the tax reform plan, originally legislated back in 2019 by the then Liberal government. In short, the Labor’s new changes have reduced the cut applied to high-income earners, and marginally increased the tax cut for mid and low-income earners:

Defending his decision to break an election promise and adjust the plan, Prime Minister Anthony Albanese has insisted that the cuts will have no impact upon inflation and RBA policy, irrespective of the latest changes – but is that true? Accordingly, what ramifications might there be for the property market?

Property Financing

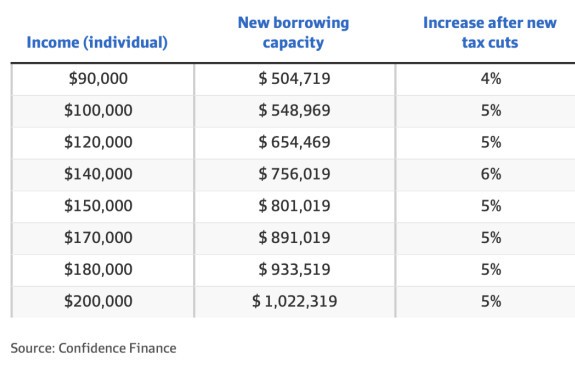

For starters, the cuts are certainly going to lift borrowing capacity. Some estimates indicate that:

“Borrowing power could increase by $15,000 for someone with $100,000 annual income and around $100,000 for someone on a $200,000 income – and that’s assuming APRA still leaves the buffer rate at 3% on lending servicing.”

Below is one estimate of the increases to borrowing capacity:

With an increase in borrowing capacity set to raise demand for property, we’re also likely to see some level of decline in distressed sales via improved levels of mortgage serviceability. We may also see much of the new demand directed towards properties at the top end of the market, with high income earners receiving the largest tax cuts. Overall, it paints a picture of heightened demand and reduced supply.

Effect on Interest Rates

Perhaps more crucially, however, is a potential impact upon monetary policy. Termed a cost-of-living measure, the proposed changes are set to benefit mid to low-income earners who tend to spend rather than save – according to AMP economist Shane Oliver. The fear is that such a change could thus act as an inflationary stimulus with higher levels of disposable income beginning to circulate.

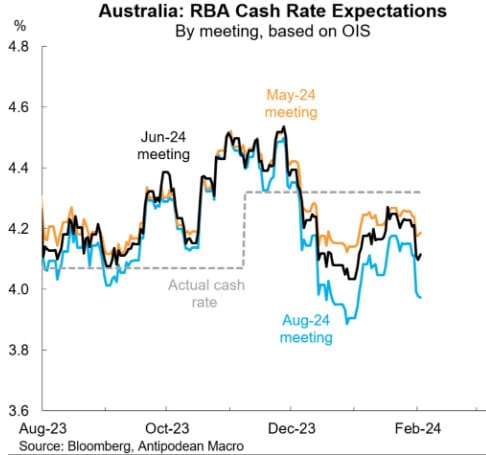

According to latest markets, it is still expected that interest rates have peaked, though some experts have expressed concern that Labor’s tax cut changes may force the RBA to delay the rate cuts that were expected by mid to late 2024.

The proposed cuts were set to add 0.1% to inflation, according to original Treasury estimates. However, both the Treasury and RBA are said to not have run complete modelling for the new changes, citing only a minor expected bump in demand. Since the size of the tax cut is set to remain unchanged at a value of $20.7bn, this is likely a fair expectation, though the redistribution of the savings and propensity for consumption at lower income levels introduces an added level of uncertainty. According to one Deloitte estimate, this could mean that the two rate cuts currently expected in 2024, might instead become one, or even none. Or, another plausible scenario might be a six-month prolonging of above 2-3% target inflation – currently expected to resume by mid 2025.

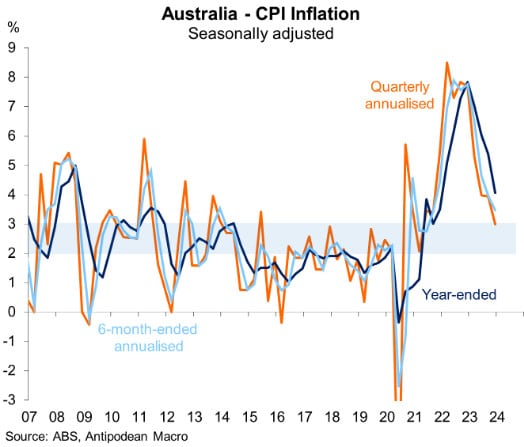

Something else that will be interesting to keep an eye on, is the RBA’s treatment of inflation figures. Though we expect the next RBA announcement to be a rate pause, as outlined in our February Market Smart, don’t be surprised if the RBA begins to cite on quarterly CPI as a case for having made progress on CPI:

This this shorter view, where inflation looks lower, may be what the RBA uses as a basis for the rate cuts that markets are expecting:

So, good news?

It does seem to be, yes!

Investors look set to gain increased borrowing capacity amidst higher demand and potentially lower levels of new listings.

On top of some of our other commentary concerning the 2024 market, this does seem to add to the sales pitch for early 2024 being a great opportunity to invest. As always though, the value of expert investment advice remains – particularly with challenging uncertainties ahead!

Want to discuss this further?

For expert guidance in property strategy, and what it could mean for you as a property investor, book in for a free consultation to make informed decisions, tailored to your investment goals. Don’t let affordability challenges hinder your success. Act now with Search Party Property!