- The first step is making the call.

- 1300 022 482

- hello@searchpartyproperty.com.au

How Can Inflation Impact Property Investors?

Inflation: An increase in the overall price level of an economy, often measured in terms of CPI (consumer price index) via the changing cost of a ‘basket of goods’ over time.

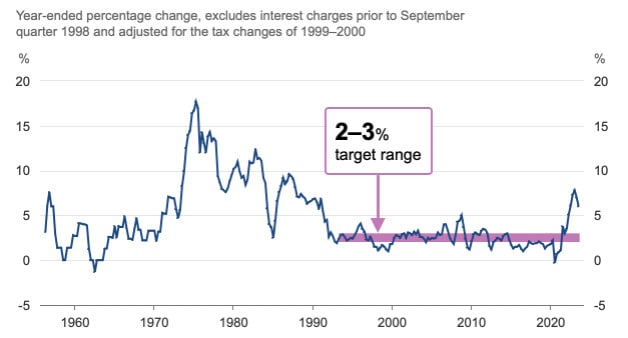

Down from a 7.8% peak earlier this year, inflation now sits at 6%. A definite improvement – but still well outside the 2-3% range that the reserve bank is tasked with maintaining.

(RBA, 2023)

Understanding the major effects of this upon the economy is simple enough. Goods and services are getting more expensive, and our purchasing power is eroding, as the ‘value’ of a dollar declines.

Thus, high inflation is unfavourable for us as consumers in the economy.

(In a prior article, we’ve explained the types and mechanics of inflation in a bit more depth).

But what about the property market? Is inflation good or bad for property investors?

This is where things can be more complex.

Debt and Inflation

Compared to simply holding onto cash as its value erodes, debtors may benefit from high inflation, thanks to the changing value of a dollar over time.

Suppose inflation is high and you’ve taken out a fixed-rate loan to buy a property. Here’s how it could work:

- Fixed payments:

Given fixed repayments, you’ll be paying the same amount of money every month, no matter how high inflation gets.

- Eroding the value of the debt:

As inflation increases, the ‘real’ value of your fixed payments decreases. In other words, you are paying the same number of dollars, but those dollars are worth less than they were when you took out the loan.

To take an example, if inflation is at 6% and you have a fixed rate 4% loan, the bank you’ve borrowed from is then losing out 2% each year, while you’re gaining 2% (plus potential property value appreciation).

In a nutshell, debt can be beneficial during high inflation because the real value of your payments goes down. You get to purchase an appreciating asset with somebody else’s money, and you then get to repay them with money that is worth increasingly less over time.

Real World Considerations:

Now, benefitting from inflation through debt may not always work out in practice, for several reasons:

- Interest Rates May Rise:

In our hypothetical example, we assumed a fixed rate home loan. However, in response to high inflation, central banks will generally raise interest rates to ‘cool’ down the economy. If you have a variable-rate loan, your payments could increase, offsetting the benefits of inflation on your debt.

- Wages May Not Keep Pace with Inflation:

If your income doesn’t increase at the same rate as inflation, you might find your living expenses going up without a corresponding increase in your ability to pay for them. This could make even fixed-rate payments more burdensome.

- Asset Value Fluctuations:

Property values don’t necessarily rise with inflation. Other factors such as local market conditions, economic downturns, or changes in neighbourhood desirability can cause property values to fall or stagnate. This may leave you with an asset that hasn’t appreciated as expected.

- Increased Costs of Ownership:

Other costs related to property ownership, such as property taxes, maintenance, insurance, and utilities, may increase with or faster than inflation. These rising costs could offset any advantage gained from the eroding real value of your fixed-rate mortgage payments.

- Potential for Deflation:

It’s difficult to accurately predict the direction of an economy. If inflation is followed by deflation (a decrease in the general price level), the real burden of debt could increase, as the value of money rises, making fixed payments more expensive in real terms.

- Other Economic Factors:

High inflation often comes with other economic challenges like instability, uncertainty, and contractionary economic policies. These broader economic factors can have complex and unpredictable effects on property investment and may offset or overwhelm any benefit gained from a fixed-rate loan during inflation.

Therefore, though it’s a useful fact to bear in mind, the complexities of economic, financial, and individual factors mean that the winners of inflation may not be exactly who we expect.

It just serves to emphasise the importance of careful planning, understanding the broader economic environment and interdependencies at play and seeking professional advice tailored to your personal situation.

Want to discuss this further?

For expert guidance in the implications of household size, and what it could mean for you as a property investor, book in for a free consultation to make informed decisions, tailored to your investment goals. Don’t let affordability challenges hinder your success. Act now with Search Party Property!